If you've been trading for a while, you probably think of OTC market hours as a standard 9:30 a.m. to 4:00 p.m. ET affair, just like the major exchanges. That’s not wrong, but it's no longer the complete picture. The old way of thinking is officially outdated.

The OTC markets have evolved into a nearly continuous, 24-hour, five-day-a-week machine, thanks to new overnight trading sessions built to connect investors across the globe.

Understanding the New OTC Trading Clock

This isn't just a simple extension of a few hours. It’s a fundamental shift in how the market operates. The market's clock has expanded to meet the demands of a globalized financial world, which means traders are no longer tethered to a single country's time zone.

Imagine you're an investor in Tokyo. News breaks that affects a U.S.-listed OTC security you're watching. In the past, you'd have to wait for Wall Street to wake up. Now, you can react and place a trade during your own business day, creating a much more dynamic and responsive environment for everyone involved.

The Rise of Overnight Trading

The biggest change is the introduction of a dedicated overnight trading window. This was created to meet the soaring demand from a new wave of global retail investors who needed the flexibility to trade outside of conventional U.S. hours. It’s been a game-changer for bridging the gap between Eastern and Western markets.

The most important development happened in June 2024 with the launch of the OTC Overnight platform. This system opened up trading from 8 p.m. to 4 a.m. ET, Sunday through Thursday, finally creating a seamless connection between international trading days.

This new session gives traders access to thousands of active OTC securities, including shares of globally recognized companies like Adidas, LVMH, Nestlé, and Nintendo. This move was a direct response to explosive growth, where an incredible 83% of Q1 dollar volume on OTC Markets came from international securities. You can get the full story by reading the official announcement from OTC Markets.

To really make the most of this expanded clock, a deep understanding of trading OTC markets is critical for building a solid strategy.

OTC Markets Key Trading Sessions at a Glance

Breaking down the new 24-hour cycle into its distinct parts makes it much easier to understand. Each session has its own unique characteristics, liquidity levels, and strategic opportunities for traders.

Here’s a quick summary of the main trading windows.

| Trading Session | Time Zone (ET) | Days | Key Characteristics |

|---|---|---|---|

| OTC Overnight | 8:00 PM – 4:00 AM | Sunday – Thursday | Caters to Asian & European market hours; liquidity builds as global markets open. |

| Pre-Market | 4:00 AM – 9:30 AM | Monday – Friday | Lower volume session where traders react to overnight news and corporate actions. |

| Core Market Hours | 9:30 AM – 4:00 PM | Monday – Friday | Highest liquidity and volume; overlaps with major U.S. exchange hours. |

| After-Hours | 4:00 PM – 8:00 PM | Monday – Friday | Used for reacting to late-day news; liquidity typically declines from the core session. |

As you can see, the market day is now a continuous flow, starting Sunday evening and running straight through Friday evening, with each session feeding into the next.

How Overnight Trading Bridges Global Markets

For a long time, the global financial markets worked like a relay race with a missing runner. The U.S. would finish its session and pass the baton, but there was a huge gap before the Asian markets fully came online. This meant traders in the Asia-Pacific (APAC) region were stuck waiting during their own prime business hours.

Overnight trading platforms have finally stepped in to fill that void. Think of them as a financial bridge connecting the continents. Now, a trader in Sydney or Seoul can start their day and immediately begin trading U.S.-listed securities, creating a much more seamless, round-the-clock global market.

This isn't just a matter of convenience; it’s about giving international investors the power to act. They can now react instantly to local economic news or geopolitical events that might affect U.S. securities, without waiting for Wall Street to wake up.

Connecting Continents with New Technology

The launch of the OTC Overnight and MOON ATS platforms in 2024 marked a huge step forward in building this global financial bridge. These systems were built from the ground up to handle the massive and growing demand from retail traders abroad who wanted a piece of the U.S. market action during their local daytime.

A recent market report shows that these platforms now offer live access to a broad array of securities, including highly liquid American Depositary Receipts (ADRs) and shares of global giants like Adidas, Roche, and Air Canada. This has completely changed the game for otc markets trading hours. For a deep dive into this expansion, check out the 2024 Annual Market Review.

Another critical piece of the puzzle is that all these trades happen in U.S. dollars. This simplifies everything for international investors by cutting out the friction of currency exchange, making U.S. markets more inviting than ever. The OTC market is truly becoming a global hub.

What You Can Trade Overnight

The new overnight sessions aren't just for a few niche stocks. They offer a diverse menu of securities that give global traders real opportunities with names they already know and follow.

- American Depositary Receipts (ADRs): These are your gateway to investing in foreign companies without navigating overseas exchanges. You can trade giants like Heineken or Nestlé just as you would a U.S. stock.

- Ordinary Shares of Global Companies: You can also buy direct shares in major international players like Bombardier and Tencent, giving you a direct stake in their success.

- National Market System (NMS) Securities: Through MOON ATS, you can even trade well-known U.S. stocks from the NYSE and Nasdaq, including popular ETFs and mega-cap companies.

This expansion does more than just cater to the surge in retail interest—it lays the foundation for deeper institutional involvement. By providing solid platforms for after-hours activity, the OTC market is proving the powerful demand for near-24-hour trading and cementing its role in the future of global finance.

The Technology Driving 24/5 Trading

The nearly continuous flow of OTC markets trading hours isn't magic. It's built on a sophisticated technological backbone designed for one purpose: to keep the markets running smoothly, 24 hours a day, five days a week. Without this robust infrastructure, the entire concept of around-the-clock trading would buckle under glitches and delays.

Think of it like the international power grid. For the lights to stay on everywhere, electricity has to flow seamlessly across borders. In the same way, market data and trade orders must zip across continents without a single hiccup. This all hinges on high-speed connectivity and specialized platforms that can process staggering amounts of data with total reliability.

This intricate network is what allows a trader in Tokyo to see the same real-time market data as an investor in New York, enabling them to trade U.S. equities confidently during their own business hours. It's this technological consistency that truly stitches the global financial ecosystem together.

The Infrastructure of Global Access

At the core of this system, you'll find Alternative Trading Systems (ATS) like MOON ATS and OTC Overnight. These platforms are the engines that power extended trading sessions. But like any high-performance engine, they need high-octane fuel—in this case, secure, low-latency data connections.

This is where specialized network providers step in. For instance, the recent expansion of global OTC trading got a major boost from key infrastructure upgrades. A pivotal development saw Transaction Network Services (TNS) establishing direct connectivity to both MOON ATS and OTC Overnight. The goal was to supercharge 24×5 market data access for clients, especially those in Asia, effectively bridging time zones and bringing U.S. equity trading into the Asian business day.

How This Benefits You Directly

So, what does all this complex infrastructure mean for you as a trader? It boils down to a few tangible advantages that can give you a real competitive edge.

- Improved Price Discovery: With more people trading around the clock, prices start to reflect a much broader range of global information and sentiment. The result? More accurate valuations.

- Reduced Liquidity Gaps: Continuous trading smooths out the jarring "gaps" in liquidity that used to be common between the U.S. market close and the Asian market open.

- Enhanced Data Reliability: A stronger tech backbone means the information you rely on is solid. Accessing real-time OTC quotes becomes a far more stable and dependable process.

Ultimately, this technology ensures the market is not just open, but also fair and efficient. It levels the playing field, giving every participant—no matter where they are—the tools needed to make timely and informed decisions.

When it comes to trading, timing isn't just a factor—it's everything. With the OTC markets' extended trading hours, the market effectively never sleeps, opening up a 24-hour cycle of opportunities. But let's be clear: not all hours are created equal. The real secret to success lies in knowing when the global markets are most alive.

The most powerful times to trade are during market overlaps. This is when the trading sessions of major financial hubs around the world are open at the same time. Imagine it like rush hour in a major city, but for capital. When the trading days of Tokyo, London, and New York intersect, the flow of money, information, and trades becomes incredibly dense.

During these peak periods, trading volume and liquidity skyrocket. This flood of activity is great for traders because it often means tighter bid-ask spreads (less cost to you) and a better chance of getting your orders filled at the price you want.

Capitalizing on Global Market Overlaps

The new OTC overnight session, running from 8 PM to 4 AM ET, was a game-changer. It was specifically created to act as a bridge between the U.S. market close and the next day's open, plugging directly into the heart of the Asian trading day and the beginning of the European one.

For instance, take the window between 8 PM and 11 PM ET. This is a sweet spot where the U.S. overnight session is active right alongside the Tokyo session. For anyone trading securities with ties to both Asian and U.S. economies, this is prime time to react to breaking news and corporate announcements.

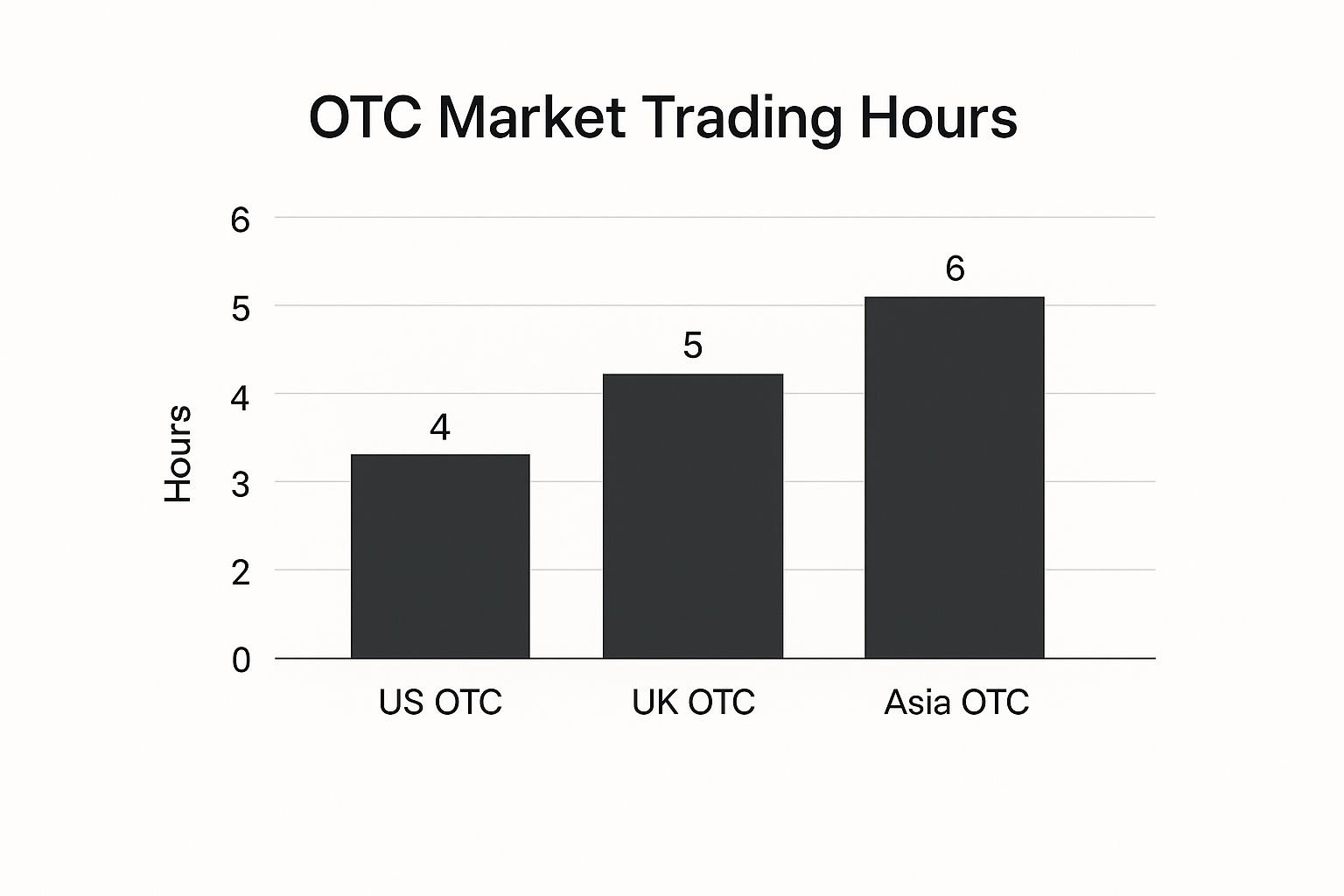

The image below gives you a great visual of how the standard trading sessions line up across the globe.

As you can see, each region offers a substantial trading window. The Asian session, in particular, is the longest and provides a massive opportunity for overlap with the new U.S. overnight hours, creating a truly global marketplace.

To really nail this down, let's look at how these major market sessions line up with the OTC's extended hours. This table breaks down when the "financial rush hours" happen.

Major Global Market Session Overlaps with OTC Hours (ET)

| Market Session | Session Hours (ET) | Overlap with OTC Overnight (8 PM – 4 AM ET) | Strategic Importance |

|---|---|---|---|

| Tokyo (Asia) | 8:00 PM – 5:00 AM | 8:00 PM – 4:00 AM (Full 8-hour overlap) | The most significant overlap. Ideal for trading U.S. stocks with Asian market exposure or reacting to Asian economic data. |

| London (Europe) | 3:00 AM – 12:00 PM | 3:00 AM – 4:00 AM (1-hour overlap) | A critical pre-market window. Captures early European sentiment before the main U.S. session opens. |

| New York (U.S.) | 9:30 AM – 4:00 PM | No direct overlap | The OTC overnight session acts as a bridge between U.S. sessions, processing after-hours news and setting the stage for the next day. |

This table clearly shows the 8-hour overlap with the Asian session is the most potent period for overnight OTC trading. The shorter, one-hour overlap with London also provides a crucial window to gauge European market sentiment right before the U.S. pre-market gets into full swing.

The Strategic Edge of Trading During Overlaps

Choosing to trade during these high-traffic windows isn't just about finding a convenient time; it's a core strategic decision. When you focus your energy on these overlap periods, you gain some serious advantages.

- Deeper Liquidity: With more traders, brokers, and institutions active, there are simply more buyers and sellers. This makes it much easier to get in and out of your positions without causing a major price ripple.

- Tighter Spreads: The bid-ask spread is the gap between what buyers are willing to pay and what sellers are willing to accept. When volume is high, competition narrows this gap, which directly lowers your trading costs.

- Actionable Volatility: While volatility can be a double-edged sword, the increased price movement during overlaps often translates into more trading opportunities, especially for those with short-term strategies.

By aligning your trading with these "golden hours," you are positioning yourself in the most dynamic part of the global market. It’s the difference between fishing in a quiet pond and a bustling river—the chances of a catch are simply much higher.

Smart Strategies for Trading After Hours

Trading outside the standard 9:30 AM to 4:00 PM Eastern Time window is a different beast altogether. The after-hours and overnight sessions have their own rhythm and their own risks. Succeeding here isn't just about being awake at odd hours; it's about having a game plan designed specifically for this unique environment.

You're primarily up against two major forces: lower liquidity and higher volatility. With fewer traders in the market, it can be tougher to get your orders filled at the price you want. At the same time, any significant news can send prices swinging wildly. Learning to navigate these two factors is the secret to protecting your account and spotting real opportunities.

Mastering Price Uncertainty with Limit Orders

When you're dealing with the unpredictable swings of extended otc markets trading hours, think of limit orders as your best friend. A standard market order gets you in or out at whatever the current price is, which can be a dangerous game after the closing bell. A limit order, on the other hand, puts you firmly in control.

Let's say a stock you're watching is hovering around $1.00 after hours. If a sudden news blip causes a spike, a market order could get filled at $1.15—way more than you wanted to pay. But if you set a buy limit order at $1.02, you're telling your broker, "I will not pay a penny more than this." It’s your built-in protection against nasty surprises.

The wider bid-ask spreads common in after-hours trading make limit orders essential. This spread represents the gap between the highest price a buyer will pay (bid) and the lowest price a seller will accept (ask). A wide spread means a market order can cost you dearly before the trade even has a chance to move in your favor.

Using limit orders is how you manage this risk head-on. You set the exact terms, which prevents costly slippage and makes sure you don't chase a bad price. It's a simple, powerful dose of discipline for a chaotic trading session.

Reacting to Global News and Events

One of the biggest edges in overnight trading is the chance to act on market-moving news as it happens across the globe. A major announcement from a European central bank or fresh economic data out of Asia can ripple through related OTC stocks almost instantly. If you're active during these hours, you get a head start.

To make this work for you, you need a clear process:

- Follow the Right Sources: Keep a close watch on reliable international financial news outlets. Set up alerts for the specific companies or industries on your radar.

- Connect the Dots: Understand how an event—like a stellar earnings report from an Asian tech company—might influence the U.S.-listed ADR you're trading.

- Act with Precision: When news breaks, be ready to move, but don't be reckless. Use your strategy and, of course, your limit orders to execute your trade without taking on unnecessary risk.

This approach flips the script, turning the challenge of overnight volatility into a genuine advantage. By staying informed and using the right tools, you can trade the news that everyone else will just be reading about over their morning coffee.

Common Myths About OTC Trading Hours Debunked

The over-the-counter world is filled with stubborn myths and old-school thinking, especially when it comes to OTC markets trading hours. These misunderstandings can easily lead to missed opportunities or, even worse, costly mistakes. It's time to set the record straight.

One of the biggest misconceptions is that OTC trading simply follows the bell of major U.S. exchanges like the NYSE. While that might have been the case years ago, it's a completely outdated view today. The game changed with the introduction of platforms designed specifically for after-hours trading.

Fact Check: The OTC market effectively operates on a nearly continuous 24/5 basis. It kicks off on Sunday evening at 8 PM ET and doesn't stop until Friday evening, a schedule built to accommodate global time zones.

What this really means is that you can now react to breaking news from Asia or market shifts in Europe long before the opening bell rings in New York.

Myth 1: After-Hours Trading Is Only for Institutions

Another myth that just won't die is the idea that after-hours and overnight trading are some exclusive club for big-money institutional players. While the big fish are definitely swimming in these waters, the modern OTC market is more open to individual retail traders than ever before.

The emergence of retail-friendly brokerage platforms and dedicated overnight systems like MOON ATS has leveled the playing field. These tools were built to meet the growing demand from individual investors around the globe who want to trade U.S. stocks on their own time.

Myth 2: All OTC Stocks Are the Same

This is a dangerous one. Many traders incorrectly throw all OTC securities into a single, high-risk bucket without realizing there are distinct tiers. The truth is much more structured. The OTC Markets Group actually categorizes companies based on how transparent and diligent they are with their financial reporting.

- OTCQX: Think of this as the premier tier. It's for established, investor-focused companies that meet high financial and disclosure standards.

- OTCQB: This is the "venture market," designed for up-and-coming companies that are committed to staying current with their reporting.

- Pink: This market is a mixed bag. It includes everything from legitimate firms that just have limited public information to companies with no current disclosure at all.

Knowing the difference between these tiers is absolutely critical. A stock trading on the OTCQX is held to a much higher standard than one on the Pink market, which has a direct impact on its risk profile and how it trades.

To dive deeper into these concepts, you can find more in-depth articles on our trading education blog.

Common Questions Answered

When you're dealing with over-the-counter securities, a lot of practical questions pop up, especially now that otc markets trading hours are longer. Let's tackle some of the most common ones I hear from traders.

Are all OTC stocks really available for overnight trading?

Not quite. The OTC Overnight platform opens the door to thousands of the most actively traded OTC equities, which is great. This includes a lot of familiar global companies and American Depositary Receipts (ADRs).

However, it's not an all-access pass to every single security on the OTC markets. Whether you can trade a specific stock overnight really boils down to two things: if it's included on the platform and if your broker-dealer offers access to it.

Can I just use a regular market order during the OTC Overnight session?

You technically might be able to, but I'd strongly advise against it. It's highly recommended to use limit orders for any trading done outside of standard hours.

Liquidity is often thinner overnight, which can lead to wider bid-ask spreads. If you place a market order, you could get a fill at a price that's way off from what you were expecting.

A limit order is your best friend here. It lets you set the absolute maximum you're willing to pay or the minimum you're willing to accept. This is a simple but powerful way to protect yourself from nasty price swings in these less liquid environments.

What about weekends or U.S. holidays? Are OTC markets open then?

No, the OTC markets stick to a standard trading week, and that includes the new overnight session. Trading kicks off Sunday evening and runs through Thursday evening, lining up with the typical U.S. trading schedule.

The markets are always closed on:

- Weekends: From the market close on Friday evening until it reopens Sunday evening.

- U.S. Market Holidays: Think Independence Day, Christmas, and other major holidays.

This structure keeps everything anchored to the primary U.S. financial calendar, even with the expanded hours.

Ready to get a critical edge during these extended sessions? With OTC Charts MT4, you get real-time, precise charting tools for Pocket Option built right into MetaTrader 4. It's the professional-grade accuracy you need to anticipate market moves 24/5. Take your strategy to the next level by visiting our official OTC Charts MT4 website today.