This guide is designed to be your go-to MetaTrader 4 tutorial. We’ll walk through everything you need to know, from the initial setup to more advanced trading workflows. My goal is to help you get comfortable and confident using this powerful platform, whether you're just starting out or looking to sharpen your skills.

Why Millions of Traders Still Swear By MetaTrader 4

Before we get into the "how-to," it’s worth taking a moment to understand why MetaTrader 4 (MT4) has remained the industry standard for so long. It’s not just about being the first major player on the scene. There are solid, practical reasons why a massive community of traders—from beginners to seasoned pros—still fire up MT4 every single day.

The platform just works. It strikes a perfect balance between being incredibly powerful and surprisingly easy to pick up. If you're new, the interface won't overwhelm you. You can genuinely learn the ropes of placing trades, analyzing charts, and managing your account in a single afternoon. This accessibility is a huge part of why so many brokers still offer it as their go-to terminal.

The Power of Simplicity and Customization

At its heart, MT4 is a charting beast. It comes loaded with all the essential tools you'd expect. You can easily draw trend lines, mark out support and resistance levels, and apply classic indicators like Moving Averages or the Relative Strength Index (RSI) right out of the box.

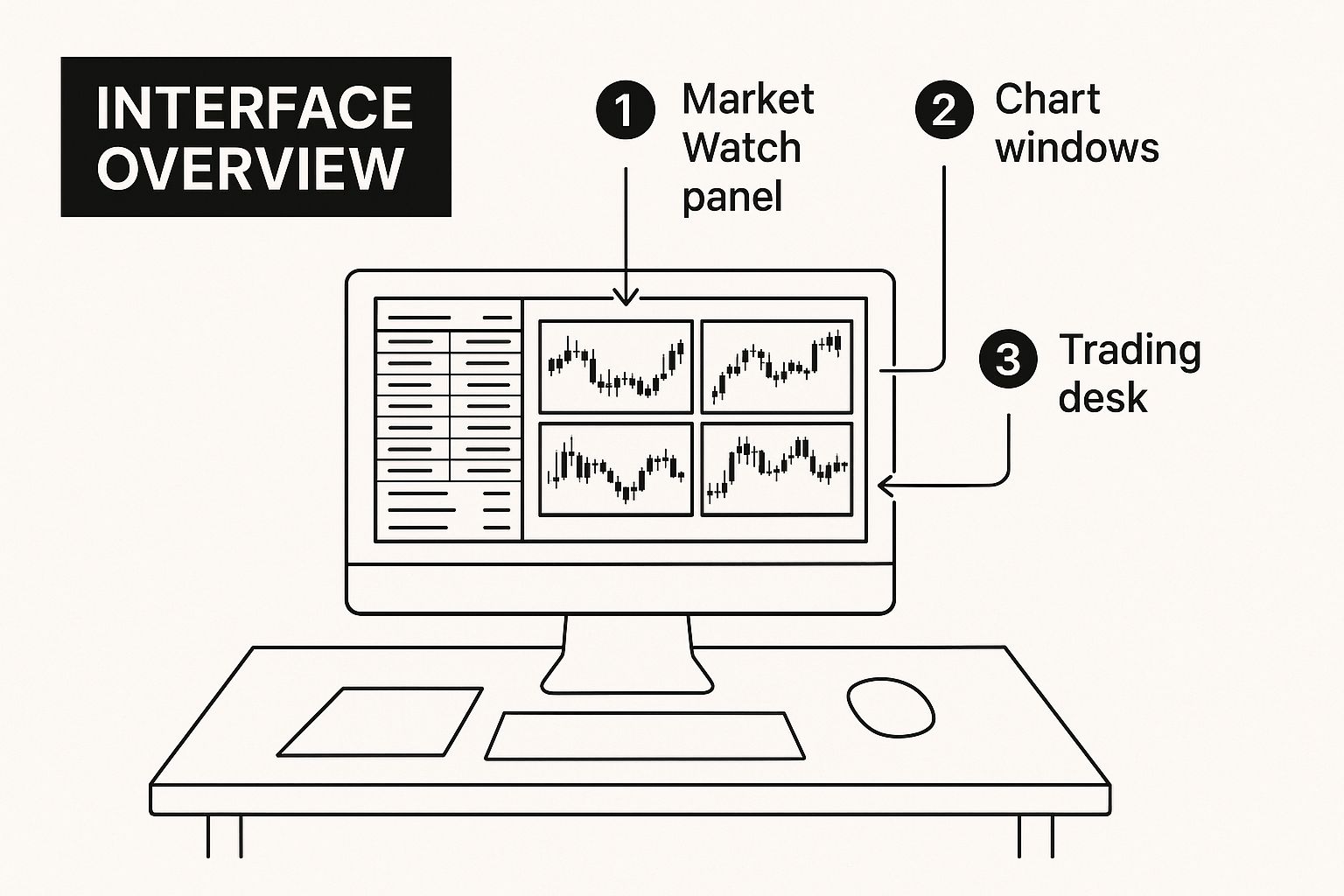

Take a look at the standard interface. It’s clean and efficient, with everything you need right in front of you.

As you can see, the Market Watch, Navigator, and Terminal windows are all logically arranged around the main chart. This setup gives you a complete command center at a glance—a foundation for the efficient workflow we're about to build in this MetaTrader 4 tutorial.

But where MT4 truly shines is in its customization. The platform is famous for its massive ecosystem of community-built tools. This opens up a whole new world of possibilities:

- Custom Indicators: Find or build tools for highly specific analysis that isn't included by default.

- Expert Advisors (EAs): These are trading bots. You can set them up to run your strategies automatically, 24/7.

- Scripts: Think of these as one-click macros. A script can perform a single, specific task, like closing all your profitable trades instantly.

Here’s a breakdown of the key features that make MT4 a powerhouse and what they mean for your trading.

MT4 Core Features and Your Trading Advantage

| Feature | Your Practical Advantage |

|---|---|

| Intuitive Interface | Spend less time fighting the software and more time analyzing the market. |

| Advanced Charting | Directly apply technical analysis with a full suite of built-in drawing tools and indicators. |

| Expert Advisors (EAs) | Automate your trading strategies to remove emotion and trade around the clock. |

| Custom Indicators | Go beyond the basics with thousands of community-developed indicators for any strategy. |

| MQL4 Language | If you have a unique idea, you (or a developer) can build a completely custom tool for it. |

| Strategy Tester | Backtest your EAs and indicators on historical data to see how they would have performed. |

Ultimately, this combination of core functionality and endless customization is what gives you a real edge.

An Unbeaten Market Leader

This mix of a user-friendly design and an open, customizable architecture has cultivated an incredibly loyal following. Even with a successor available, MT4 continues to dominate the retail trading world.

It’s estimated that a staggering 85% of all forex traders use MetaTrader 4 globally. With a user base of over 8 million traders, it dwarfs its successor, MT5, which is used by only about 6% of the market. If you're curious, you can explore more trading platform statistics to see the full picture.

Getting Your MT4 Trading Environment Set Up

Before you can even think about analyzing the market or placing a trade, you need to get your workspace in order. Think of your MetaTrader 4 platform as your personal command center. The time you spend setting it up now will pay off tenfold in efficiency later on.

First things first, you need to install MT4. Always get the installation file straight from your broker’s website. Don't just grab it from a random third-party site. Brokers usually offer a version that’s already configured for their servers, which makes logging in a breeze and keeps your connection stable.

After you run the installer, the first thing MT4 will do is ask you to connect to an account. This is where you'll plug in the credentials your broker sent you when you signed up.

Connecting Your Account and Finding Your Way Around

When you first open the platform, a login window will pop up asking for your account number, password, and the server. That server name is critical. Most login problems happen because traders pick the wrong one from the list. Make sure you select the exact server your broker specified, whether it's "BrokerName-Live" or "BrokerName-Demo."

Once you’re in, you’ll see the standard MT4 layout. It’s usually a bit cluttered with four default charts and a few different panels. Let's break down the most important ones you'll be using constantly.

- Market Watch: This is your go-to list of tradable instruments and their live bid/ask prices. The keyboard shortcut is Ctrl+M. You can right-click in this window to customize which symbols you see.

- Navigator: Use this (shortcut: Ctrl+N) to flip between your trading accounts or to grab indicators, Expert Advisors, and scripts from your library.

- Terminal: This panel lives at the bottom of the screen (shortcut: Ctrl+T). It's where you'll see your open trades, check your account history, get messages from your broker, and manage alerts.

These three windows are the heart of your daily routine in MT4. Feel free to drag them around and resize them until the layout feels right for you.

Customizing Charts for Smarter Analysis

The default charts in MT4 are okay, but they're pretty generic. The real magic happens when you customize them to fit your trading style. This isn't just about picking pretty colors; it's about creating a view that helps you spot market patterns more easily.

I suggest closing the default charts and opening a fresh one for an asset you trade a lot. Then, just right-click on the chart and hit "Properties" (or use the F8 key). From here, you can change everything—the background color, the grid, and how your candlesticks look. A lot of traders I know, myself included, prefer a dark theme with bright candles (like green for up-moves and red for down-moves). It's just easier on the eyes during a long trading day.

With your colors set, start adding your favorite indicators. Maybe that’s a 50-period moving average and an RSI. Get it looking exactly how you want it. Now for the most important part: save it as a template.

Pro Tip: Right-click your perfectly configured chart, hover over "Template," and click "Save Template." Give it a name you'll remember, like "My Day Trading Setup." Now you can apply this entire setup—colors, indicators, everything—to any new chart with just two clicks.

This one habit is a huge time-saver and keeps your analysis consistent. If you're just starting out and aren't sure which indicators to use, checking out a solid technical analysis for beginners guide can give you some great ideas for your first template.

Believe it or not, MT4's rise to fame, starting back in 2005, was largely due to features just like this. The ability to build and run automated trading strategies, called Expert Advisors (EAs), brought algorithmic trading to the masses—something that used to be only for big institutions. By mastering simple tools like templates, you're building on that legacy of efficiency that made MT4 a giant in the trading world.

Integrating OTC Charts for Broader Market Analysis

While MetaTrader 4 is a beast when it comes to standard forex pairs, its default setup doesn't cover everything. A lot of traders, especially if you're working with binary options on platforms like Pocket Option, need a way to analyze over-the-counter (OTC) instruments. This is where a good plugin becomes essential, acting as a bridge between MT4's powerful charting tools and the unique data streams from OTC markets.

Bringing in a dedicated OTC chart module lets you perform all your analysis right inside your familiar MT4 terminal. Forget about flipping between different platforms. You can pull real-time OTC quotes into the same workspace you use for everything else. This creates a much more streamlined and efficient workflow, which is really what this whole MetaTrader 4 tutorial is about.

This image below is a perfect example of what a well-organized MT4 workspace looks like. When you have everything—from your watch lists to multiple charts—in one unified view, you can make decisions much more effectively.

Having all your critical information displayed so cohesively is a game-changer for serious analysis.

Finding and Installing an OTC Chart Plugin

First things first, you need to get your hands on a reliable plugin. For traders on Pocket Option, the OTC Charts MT4 module is built specifically for this job. You'll typically download an installer file directly from them. A word of advice: always download from the official source to steer clear of any security headaches.

The installation itself is usually a breeze:

- Close MetaTrader 4: Before you do anything else, make sure your MT4 platform is completely shut down. This is a crucial step.

- Run the Installer: Double-click the file you downloaded. In most cases, the installer is smart enough to find your MT4 directory on its own. If you have multiple MT4 installs from different brokers, you might have to manually guide it to the right one.

- Relaunch MT4: Once the installation finishes, fire up your MetaTrader 4 platform again.

Now, you just need to confirm the plugin is active. Pop open the Navigator window (you can use the shortcut Ctrl+N) and look under the "Expert Advisors" tree. You should see your new OTC chart tool listed right there.

Connecting to the Live OTC Data Feed

With the tool installed, the next step is getting it hooked up to the live data feed. This is what pipes the real-time price movements for OTC assets directly into your platform.

To get started, find the OTC chart EA in your Navigator and drag it onto any chart window. I usually just use a spare EURUSD chart as a host—it doesn't matter which one. As soon as you drop it, a properties window will appear. This is where the magic happens.

The properties window is your control center for the plugin. You'll see fields for your login credentials (which you get from the OTC chart service). More importantly, you have to make sure the "Allow DLL imports" and "Allow live trading" boxes are checked. These permissions are non-negotiable; they allow the tool to fetch external data and work properly.

After you've entered your details and clicked "OK," the plugin will kick into gear. You should see a little status indicator on the chart, usually in a corner, confirming it has connected to the data server. If you see an error, the first thing to do is double-check your login info and those permission settings. For a deeper dive into the specifics of these markets, check out this guide on how to trade OTC markets.

Opening and Analyzing OTC Instruments

Once you're connected, you can finally start charting OTC assets. The process is a bit different from opening a standard forex pair. Instead of using the Market Watch, you'll use the plugin to generate "offline" charts for the OTC instruments you want to trade (like EURUSD-OTC or AUDCAD-OTC).

From the main MT4 menu, navigate to File > Open Offline. A list will pop up, and in it, you'll find all the OTC instruments being fed by your plugin. Just select the one you want to analyze, and a brand-new chart window will open, populated with live-updating OTC data.

The best part? This new chart behaves just like any other MT4 chart. You can:

- Apply your favorite technical indicators.

- Draw trend lines, support/resistance, and Fibonacci levels.

- Save your entire analysis setup as a template to quickly apply it to other OTC charts.

For example, a common approach I use is to apply a 20-period Exponential Moving Average (EMA) along with the Stochastic Oscillator to an OTC chart. This helps me spot short-term shifts in momentum. Since it’s all happening inside MT4, you can use the powerful analytical tools you already know on a whole new set of instruments.

Turning Analysis into Action: Placing and Managing Your Trades

Alright, you've got your charts set up and your analysis is pointing to an opportunity. This is where the rubber meets the road—the moment you move from watching the market to actively participating in it. It's time to place your first trade.

The whole process starts with your read on the market. MetaTrader 4 gives you a solid toolkit right out of the box. You don't need to clutter your screen with dozens of indicators. In fact, many seasoned traders find that mastering a few core tools is far more effective. A simple Moving Average can cut through the noise to show you the underlying trend, while an indicator like the Relative Strength Index (RSI) is fantastic for spotting potential exhaustion points where a market is overbought or oversold.

Combine these indicators with some basic drawing tools, and you have a powerful setup. Drawing a few trend lines can quickly map out the market's path, while plotting horizontal lines at key support and resistance levels shows you the price zones that matter. The goal here is to build a clear, visual story of what the price has been doing and where it might be headed next.

Choosing an Order Type That Fits Your Plan

Once your analysis gives you the green light, you have to decide how you want to enter the market. MT4 offers a few different ways to do this, and your choice should always align with your trading strategy.

- Market Order: This is your "get me in now" button. It executes your trade instantly at the best available price. It's perfect for when timing is critical, but be prepared for a tiny bit of "slippage"—a slight difference between the price you saw and the price you got.

- Limit Order: This is for the patient trader looking for a better price. A "Buy Limit" is placed below the current price, and a "Sell Limit" is placed above it. You use this when you expect the price to hit a certain level and then reverse in your favor.

- Stop Order: This is your tool for breakout trading. A "Buy Stop" goes above the current price, and a "Sell Stop" goes below it. It’s triggered when you believe that once a key level is broken, momentum will carry the price much further in that same direction.

Simply put, a market order is for speed, while limit and stop orders are for precision. Your choice is a direct reflection of your strategy.

A Real-World Walkthrough: Placing Your First Trade

Let's walk through a practical example. Say your analysis on the EUR/USD chart points to a solid buying opportunity. The quickest way to get started is by hitting the F9 hotkey on your keyboard—this instantly pulls up the "New Order" window. Trust me, you'll be using this shortcut a lot.

Inside the order window, you'll define your trade. Double-check that the "Symbol" is correct and set your "Volume," which is your position size in lots. Now for the most important part: setting your risk management levels.

- Stop Loss: This is the price where your trade will automatically close for a predetermined loss. It’s your financial safety net. A single bad trade should never wipe out your account.

- Take Profit: This is your exit target—the price where your trade automatically closes in profit. This locks in your gains when your target is hit, removing emotion from the decision.

Your Stop Loss and Take Profit levels aren't just random guesses. They should be strategic decisions rooted in your chart analysis. For a buy trade, a smart Stop Loss is often placed just below a recent support level. Your Take Profit could be set just before the next major resistance area.

With your levels locked in, select your order "Type"—for this example, we'll stick with "Instant Execution" for a market order. Click "Buy," and that's it. Congratulations, you're officially in the market!

You can keep an eye on all your open trades and pending orders from the "Trade" tab in the Terminal window (just press Ctrl+T to bring it up). As you can see in the screenshot below, tools like trend channels are drawn directly on the chart to help you make these trading decisions in the first place.

This chart is a great example of how you can use drawing tools to visualize where the price might be heading. Once your trade is live, the Terminal becomes your mission control, showing your real-time profit or loss and allowing you to manage your positions effectively.

Fine-Tuning Your MT4 Workflow for Peak Efficiency

Getting the basics of MetaTrader 4 down is one thing, but truly making the platform work for you is what separates the pros from the crowd. Once you’re comfortable placing trades and dropping standard indicators on a chart, it's time to build a trading environment that's powerful and perfectly tailored to your style. This is how you move beyond the default, "out-of-the-box" experience.

Ready to start trading like a seasoned pro? These are the workflow hacks I've seen countless experienced traders use to save precious time and make sharper decisions. We'll dig into using profiles to manage different strategies, where to find custom tools to supercharge your analysis, and how to use shortcuts to act on opportunities in a heartbeat.

Use MT4 Profiles to Organize Your Strategies

Most traders I know don't stick to a single strategy. You might have one setup for scalping EUR/USD during the London session and a completely different one for swing trading AUD/JPY on the daily charts. Trying to juggle those different views can get messy and slow you down.

This is where Profiles become an absolute game-changer.

Think of a profile as a complete snapshot of your entire workspace. It remembers every open chart, its timeframe, any templates you've applied, and every single indicator or drawing tool you've placed. It's so much more than a chart template; it's a saved layout for your entire MT4 terminal.

For instance, you could create a "Forex Majors" profile with your EUR/USD, GBP/USD, and USD/JPY charts, each loaded with your favorite day-trading indicators. Then, you could have a separate "Commodities" profile with Gold and Oil charts using a completely different set of long-term analysis tools.

Switching between these entire workspaces is effortless:

- Navigate to File > Profiles.

- Just click the profile you want to load.

In an instant, MT4 will close all your current charts and load the exact arrangement you saved. This simple feature is unbelievably effective for staying organized and laser-focused on one strategy at a time without rebuilding your charts every single day.

Expand Your Arsenal with Custom Indicators and EAs

While the built-in tools are a great start, the real power of this platform comes from its massive user community. The MQL5 community is a treasure trove where developers share thousands of custom indicators and Expert Advisors (EAs). Many of these are free and can offer analytical angles you simply won't find in the standard MT4 package.

Finding and installing them is incredibly simple:

- First, open the Terminal window (you can use the shortcut Ctrl+T).

- Next, click on the "Market" tab at the bottom.

- From there, you can browse, search, and download tools directly into your MT4 platform.

Once you download a new tool, it will pop up in your Navigator window. You can then just drag and drop it onto a chart, exactly like you would with a default indicator. This unlocks a world of possibilities, from indicators that automatically draw trend channels to EAs that can manage your trades for you. This functionality is a cornerstone of any good MetaTrader 4 tutorial because it lets you build a platform perfectly suited to your specific needs.

A Quick Word of Caution: Always, always test new custom indicators or EAs on a demo account first. While many tools are fantastic, you need to understand exactly how they work and be sure they're reliable before you risk a single dollar of real capital.

Master Hotkeys and Alerts for Lightning-Fast Execution

In trading, every second can count. Fumbling through menus to place an order or find a drawing tool can mean missing that perfect entry you were waiting for. Learning a few essential hotkeys will dramatically speed up your workflow.

Here are a few of the most useful shortcuts that every trader should burn into their memory:

- F9: Instantly opens the "New Order" window.

- Ctrl+T: Toggles the Terminal window on and off.

- Ctrl+N: Toggles the Navigator window.

- Ctrl+G: Shows or hides the chart grid.

- F8: Opens the chart properties window for quick visual tweaks.

Beyond shortcuts, Price Alerts are like having a personal assistant watch the market for you. Instead of being glued to the screen waiting for price to hit your target, you can have the platform notify you.

To set one up, head to the "Alerts" tab in your Terminal window, right-click, and select "Create." You can have it trigger a pop-up, play a sound, or even send an email when price hits a certain level. For example, if you're waiting for EUR/USD to break above key resistance at 1.0750, set an alert right there. The platform will do the waiting for you, freeing you up to analyze other opportunities.

Common Questions About Using MetaTrader 4

Even after going through a great MetaTrader 4 tutorial, you're going to have questions. It’s a powerful platform with a lot of depth, and some situations can trip up even seasoned traders. Let's walk through some of the most common issues I see people run into and get you the straightforward answers you need.

Why Is My Trade Not Executing?

It’s one of the most frustrating things that can happen. You’ve lined up the perfect trade, you click "Buy" or "Sell," and… crickets. So what's going on?

Most of the time, it's either the market itself or a simple mistake in your order settings. If the market is moving quickly, the price you clicked might have vanished by the time your order hit the server. That's called slippage.

Another culprit is setting your Stop Loss or Take Profit levels incorrectly. Think about it: if you're buying, your Stop Loss has to be below the current price, and your Take Profit has to be above it. The reverse is true for a sell order. If you mix these up, MetaTrader 4 will just reject the trade. Always give those parameters a quick once-over in the F9 order window before you commit.

Can I Use MetaTrader 4 on a Mac?

Absolutely, you can use MT4 on a Mac, though it takes a small extra step. The platform was originally built for Windows, so there's no native macOS version from the developer. The good news is that most good brokers have already solved this for you. They typically offer a pre-packaged version that runs perfectly on Mac using a compatibility layer like Wine.

Getting it running is usually a breeze:

- Find and download the Mac-specific MT4 installer right from your broker's website.

- Once it's downloaded, just drag the app into your "Applications" folder.

- Double-click to run it like any other program on your Mac.

Even though it’s not a native app, I’ve found the performance is more than enough for charting, analysis, and manual trading.

The single best piece of advice here is to use the version your broker provides. It's already configured for their servers and has been tested for stability, which can save you a world of technical headaches.

Why Do My Charts Look Different From My Broker's?

This is a classic point of confusion. The chart you see on a third-party site looks totally different from what's on your MT4 platform. It almost always boils down to one of two things: the data feed or the time zone.

First, the easy one. Make sure you're logged into the right server. A broker's "Broker-Live" and "Broker-Demo" servers are often separate, and there can be tiny differences in the data feeds.

More often than not, though, the problem is the time zone. Your MT4 platform’s clock is locked to your broker's server time (for example, GMT+2), and you can't change it. If your other charting tool is set to a different time zone, like New York time (GMT-5), the candles won't line up. A 4-hour candle on one chart will open and close at a completely different time than on the other, changing the entire look of the price action.

How Can I See My Trading Performance?

MT4 has some solid built-in tools for this. Your main hub is the "Account History" tab, which you can pop open by hitting Ctrl+T in the Terminal window. From there, you can right-click and save a detailed report to an HTML file. This report is fantastic for getting a high-level overview, showing you key stats like your profit factor, total drawdown, and your win/loss ratio.

For deeper insights, many traders (myself included) rely on external trade journals. A detailed log helps you connect the dots and spot behavioral patterns—like always losing money on Tuesdays—that a simple report might not reveal. The key is consistent review. If you want a deeper dive, you can learn more about how to track your trading performance to get a true handle on your progress.

Ready to elevate your trading with professional-grade tools? OTC Charts MT4 provides the real-time, accurate over-the-counter data you need, seamlessly integrated into your MetaTrader 4 platform. Stop guessing and start analyzing with precision. https://otc-charts-mt4.com