Let's get one thing straight: a winning trading mindset is what truly separates the consistently profitable traders from everyone else. It’s not about having a secret indicator or a magic formula. It's the mental bedrock—built on rock-solid discipline, emotional control, and a methodical approach to every single decision you make in the market.

This mindset is what empowers you to execute your strategy perfectly, even when the market is throwing everything it has at you.

The Unseen Force Behind Every Winning Trade

Picture a seasoned pilot flying through a violent storm. While the passengers are white-knuckled, the pilot is calm, focused, and trusts their training and instruments completely. That’s the kind of mental state we're talking about. Your trading mindset is your internal control panel, keeping you steady when the markets turn chaotic.

Without this inner control, even the most brilliant trading strategy is doomed.

Many new traders get it backward, thinking success is 95% strategy and 5% psychology. Anyone who's been in the trenches knows the reality is closer to the opposite. A solid strategy is your ticket to the game, but your mindset determines if you can actually play to win. The path to consistent profits is far less about discovering a hidden market secret and far more about mastering your own reactions to risk, loss, and opportunity.

Winning vs. Losing Mindset at a Glance

To make this crystal clear, it helps to see the two opposing mindsets side-by-side. The differences are stark and often subtle, but they are what determine your long-term results. This table breaks down the core distinctions so you can quickly see where you stand.

| Characteristic | The Winning Trading Mindset | The Losing Trading Mindset |

|---|---|---|

| View of Losses | An expected business cost; a data point for improvement. | A personal failure; a reason to panic or seek revenge. |

| Decision Making | Based on a pre-defined, tested trading plan. | Driven by emotions like fear, greed, or hope. |

| Focus | On flawless execution of the process and risk management. | On the outcome of the current trade; a need to be "right." |

| Risk | Calculated and controlled on every single trade. | Inconsistent; either too small (fear) or too large (greed). |

| Patience | Waits for high-probability setups that fit the plan. | Jumps into trades out of boredom or fear of missing out. |

Looking at this table, be honest with yourself. Which column more accurately describes your typical trading day? Recognizing the "losing" traits in yourself is the first, most crucial step toward building a professional, winning mindset.

The Core Pillars of a Resilient Mindset

Developing this mental toughness isn't about chanting affirmations; it's about building practical, everyday skills. These pillars work together to create the professional approach you need.

- Discipline: This is non-negotiable. It's the simple, brute-force ability to follow your trading plan without caving to fear or greed.

- Patience: You have to learn to sit on your hands. It means waiting for the A+ setups that meet your strict criteria, not forcing B- trades because you're bored.

- Emotional Neutrality: Emotions will always be there. The key is to acknowledge them—fear, excitement, hope—and then politely show them the door so they don't influence your trading decisions.

- Systematic Risk Management: You must treat every trade as just one of a thousand. That means having predefined risk controls that protect your capital, no matter what.

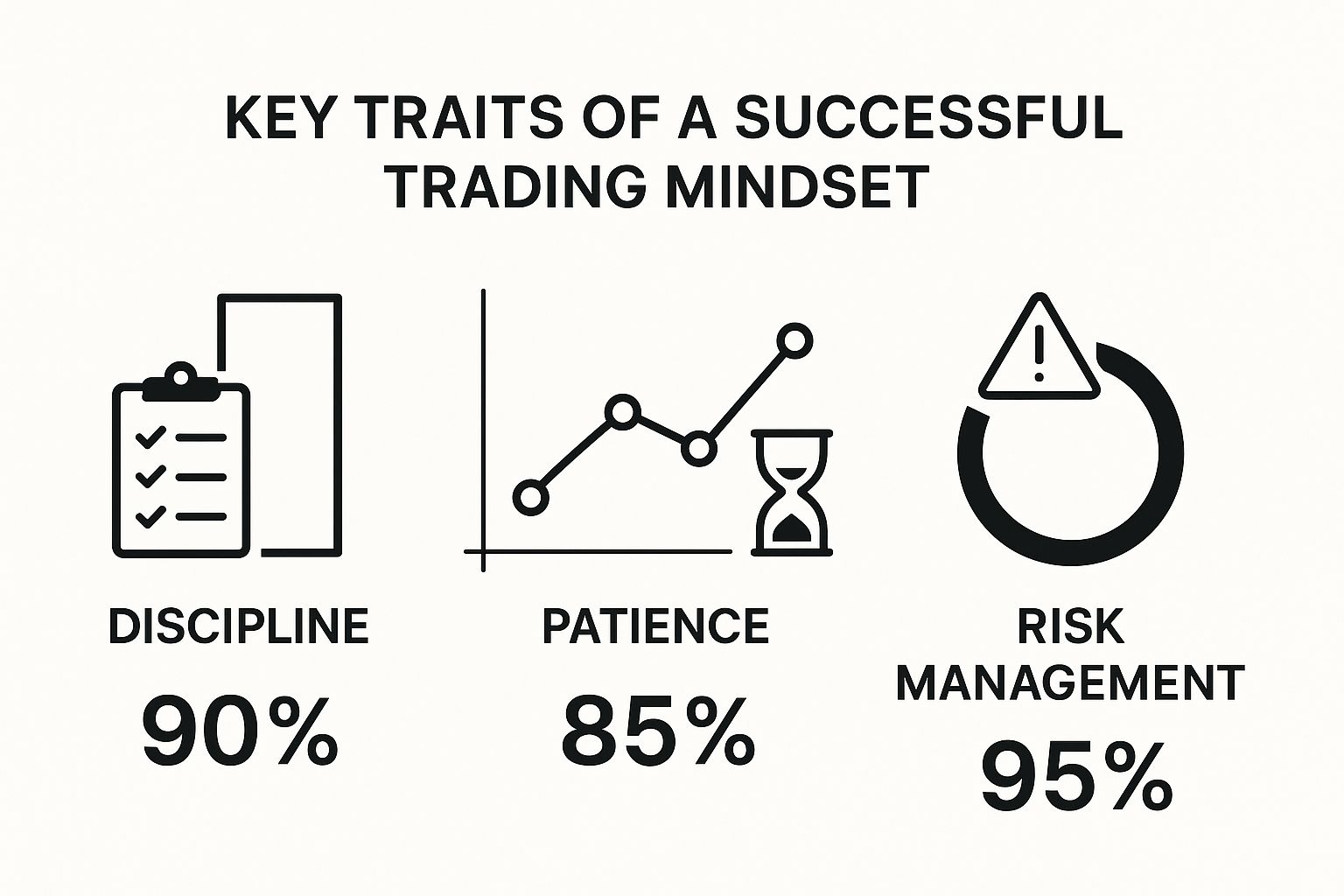

This isn't just theory. Look at what the data says about what matters most.

The numbers don't lie. Risk management and discipline are seen as absolutely critical by nearly everyone who succeeds. These aren't just helpful suggestions; they are the non-negotiable pillars of a professional trading career.

Why Market History Shapes Your Trading Mind

If you want to build a truly resilient trading mindset, you first have to grasp one of the market’s deepest truths: human emotion doesn’t change. Technologies evolve, new assets appear, but the raw, collective forces of greed and fear are timeless. They’re the invisible engine that has powered every boom and bust cycle throughout history.

Think of market history less like a dry textbook and more like a collection of stories about mass psychology in action. Studying these events gives you a powerful lens for understanding what’s happening right now. It’s like a meteorologist studying past hurricanes to better forecast the path and intensity of an approaching storm.

When you learn to spot these recurring emotional waves, you give your trading mindset a defense against the magnetic pull of the herd. You start to see the tell-tale signs of irrational exuberance or brewing panic, which helps you stay objective when everyone around you is acting on impulse. This historical perspective becomes your anchor in a sea of market noise.

Echoes of Greed and Fear Through Time

History is littered with examples of investor psychology dictating market outcomes. These cycles tend to follow a familiar script: a period of extreme optimism inflates a massive bubble, which eventually pops, leading to panicked selling. It’s a drama fueled entirely by the pendulum swing between greed and fear.

From the Dutch tulip craze in the 1600s to the dot-com bubble of the late 1990s, the narrative is eerily similar. We even saw it in the early 2020s with the wild speculation in crypto and NFTs, where sky-high valuations were followed by brutal corrections. You can explore more on how these cycles repeat on socratesplatform.com.

Knowing this changes how you see volatility. Instead of getting swept away by the emotional tide, you become an observer, able to spot the patterns that most people miss entirely.

Turning Historical Lessons into a Practical Edge

So, how does studying a 17th-century flower market actually help you trade today? It builds critical psychological defenses that are just as relevant whether you’re trading forex, stocks, or binary options.

The point of studying market history isn't to predict the future with 100% certainty. It’s to prepare your mind for its possibilities. It gives you the patience to wait for the right moment and the courage to act when your analysis—not the crowd—tells you it's time.

By internalizing these lessons from the past, you start to develop the core traits of a professional trader:

- Patience: When you understand the anatomy of a bubble, you're less likely to chase an asset at its peak just because you have a Fear of Missing Out (FOMO).

- Objectivity: You begin to see market crashes not just as a catastrophe, but as a potential opportunity created by widespread, irrational fear.

- Discipline: Your decisions become rooted in historical context and a solid strategy, not the emotional whims of the masses.

This historical awareness is what hardens your trading mindset against the most common and costly psychological mistakes. It provides the bigger picture you need to stay in control, stick to your plan, and navigate today’s markets with a calm, strategic edge.

How an Analytical Mindset Transforms Trading

The biggest leap any trader makes is when they stop guessing and start analyzing. It’s a profound shift, moving away from pure instinct and toward a methodical, data-driven approach. This doesn't mean you completely shut off your intuition. Instead, you learn to back it up with hard evidence.

Think of it like this: you can guess where a storm might hit, or you can use meteorological data to track its exact path. Which approach would you bet your house on?

This evolution from gut-feel to evidence-based trading isn't new. It was pioneered by market legends who wanted to take the emotional chaos out of their decision-making. The rise of quantitative trading in the 1980s and the principles of technical analysis, which trace back to Charles Dow in the early 1900s, were both fueled by this same analytical drive. You can actually dig into the fascinating history of these trading approaches on QuantifiedStrategies.com to see how far we've come.

When you fully embrace an analytical mindset, you stop seeing the market as a casino. It becomes a complex system of probabilities, one that you can study, understand, and navigate with a plan.

From Emotional Reactions to Strategic Responses

An analytical framework is your best defense against your own emotional impulses. We've all been there. A trade goes against you, and your mind starts screaming, "Get out now!" or, maybe worse, "Just hold on, it has to come back!" That’s your fear and hope talking, not your strategy.

A trader with an analytical mindset operates from a place of preparation. They've already defined their risk and know their exact exit point before the trade is even placed. The decision isn't made in the heat of the moment; it was made when they were calm, objective, and thinking clearly.

This methodical process is the very foundation of a resilient trading mindset. It builds confidence not because you think you’ll never lose, but because you have a tested plan for any outcome.

An analytical mindset doesn't promise you'll always be right. It promises you'll always be prepared. This preparation is what turns fear into focus and uncertainty into a clear, actionable plan.

Building Confidence Through Repeatable Processes

Real confidence in trading doesn’t come from a lucky winning streak. It’s forged by knowing your process is solid, tested, and repeatable. When your strategy is built on data and clear rules, a single loss doesn't shatter your confidence, because you trust the system, not the outcome of one trade.

This process-first approach gives you some serious psychological advantages:

- You become more adaptable. An analytical trader isn't emotionally attached to a single market view. When new data comes in, they adjust their strategy based on fresh evidence, not ego.

- You reduce decision fatigue. With a systematic plan in place, you’re not constantly wrestling with high-stakes decisions on the fly. Your pre-defined rules do the heavy lifting for you.

- You execute with a clear head. When the market gets choppy and chaotic, your analytical framework is your anchor. It keeps you grounded in your strategy, letting you execute with precision while others are swept away by emotion.

At the end of the day, an analytical mindset does more than just give you buy and sell signals. It builds the mental discipline, confidence, and adaptability you need to navigate any market with a steady hand.

Conquering Your Inner Trading Saboteurs

Let's be blunt: every trader has an inner enemy, a saboteur working to undermine their success. These aren't character flaws. They’re cognitive biases—mental shortcuts hardwired into our brains that, while useful for daily life, can be absolutely devastating in the financial markets. They quietly unravel even the most well-thought-out trading plans.

Developing a strong trading mindset isn't about trying to eliminate these biases. Honestly, that's impossible. It's about learning to spot them when they creep in and having a rock-solid plan to shut them down. Think of this as your field guide for identifying and neutralizing the mental traps that derail smart traders every single day.

Unmasking the Most Common Biases

These internal saboteurs are sneaky. They often show up disguised as "gut feelings" or common sense. To beat them, you have to be able to call them out in the heat of the moment. Let’s pull back the curtain on three of the most destructive ones.

1. Confirmation Bias

This is a big one. It's our natural tendency to hunt for information that proves we’re right while conveniently ignoring anything that suggests we might be wrong. It feels good to be right, and this bias feeds that very human need.

- How It Trips You Up: You go long on a currency pair. The price immediately starts to fall. Instead of reassessing, you frantically google for news articles or analyst opinions that support your original "buy" idea, convincing yourself it’s just a temporary dip.

2. Loss Aversion

Study after study shows that the psychological sting of a loss is roughly twice as powerful as the pleasure of a gain. This is a massive emotional force that causes us to do incredibly irrational things just to avoid taking a loss.

- How It Trips You Up: Your trade hits your pre-determined stop-loss. But instead of closing the position and taking the small, managed loss, you freeze. You tell yourself, "I'll just wait for it to get back to breakeven," a decision that often turns a small, acceptable loss into a catastrophic one.

3. Recency Bias

This bias tricks us into giving far too much weight to recent events. If you've just rattled off a string of wins, you start to feel invincible. On the flip side, a few losses in a row can make you too timid to pull the trigger on the next perfectly valid setup.

- How It Trips You Up: After nailing five winning trades in a row with a specific setup, you get cocky. On the sixth trade, you double your position size, completely ignoring your risk management rules. Why? Because your recent success has made you feel bulletproof.

Your mind will always look for the easiest path. Cognitive biases are shortcuts that feel right but often lead directly to poor decisions. The antidote is a non-negotiable, pre-defined trading plan that you trust more than your in-the-moment feelings.

Your Tactical Defense Plan

Knowing what these biases are is step one. But awareness alone doesn't protect your trading account—action does. You need simple, concrete tactics to fight back when these mental gremlins inevitably show up.

Here’s your action plan:

- Create a "Devil's Advocate" Checklist: Before you even think about placing a trade, force yourself to find at least two solid reasons why the trade might fail. This is a direct counterattack on confirmation bias, compelling you to see the other side of the argument.

- Use Hard Stop-Losses: A hard stop-loss entered into your trading platform is a rule that cannot be debated. It automates your exit, ripping the emotional struggle of loss aversion completely out of the decision-making process.

- Keep a Detailed Trading Journal: A journal gives you cold, hard data on your performance over hundreds of trades. It’s a powerful reminder that your last few trades (recency bias) are just a tiny blip on the radar, keeping you grounded in your long-term statistical edge.

Building these defenses is a crucial part of developing a professional-grade mental edge. For a deeper dive into these strategies, you can explore our detailed guide on essential trading psychology tips. At the end of the day, mastering these internal battles is what separates the amateurs from the pros.

Building Unshakeable Discipline with Data

"Be more disciplined." It's the most common piece of trading advice out there, but it often feels like a vague, abstract goal. How do you actually build discipline?

The secret isn't just willpower. The most direct path to unshakeable discipline is through data. It's what turns trading from a gut-feel, hope-and-fear rollercoaster into a calm, evidence-based operation.

Think about a professional storm chaser. They don't just drive toward dark clouds and hope for the best. They meticulously study weather models, historical storm patterns, and atmospheric data. This data-driven approach removes emotion and replaces it with a calm, analytical plan. As a trader, historical market data is your weather map.

Turning Data into Confidence

When you lean on data, your decisions stop being emotional guesses and start becoming strategic responses. You're no longer staring at a chart, wondering what the market might do next. Instead, you're simply executing a plan based on what similar market conditions have produced time and time again. This shift is the very foundation of a professional trading mindset.

A huge part of this is using historical data to get a handle on risk. By looking at how an asset has behaved in the past—its volatility, its biggest drops—you can quantify your risk. This lets you set intelligent position sizes and stop-loss levels that actually protect your capital, rather than just picking a random number. This kind of preparation, grounded in facts, is what separates successful traders from gamblers. You can dig deeper into how traders make informed decisions with historical data on Adrofx.com.

True discipline isn't about forcing yourself to follow rules you don't trust. It's about having so much data-backed conviction in your strategy that breaking the rules feels completely illogical.

A Practical Framework for Data-Driven Discipline

Building this kind of discipline is a process. It doesn't happen overnight. It involves methodically turning raw market history into your personal playbook—one that gives you the confidence to act decisively, especially when the pressure is on.

Here’s a simple framework to get started:

- Quantify Your Risk: Before you even think about entering a trade, use historical data to find a logical stop-loss. Look at the asset's average price swings to set an exit point that gives your trade room to work without exposing you to a massive loss.

- Validate Your Setups: Don't just assume your strategy works. Backtest it. Run your trading ideas against past market data to see how they would have performed. This shows you the statistical edge of your strategy, building the deep belief you need to execute without hesitation.

- Set Realistic Profit Targets: Data tells you what a reasonable gain actually looks like for a specific trade. This helps you avoid closing a position too early out of fear or holding on for way too long because of greed.

This whole process—backtesting, analyzing, and refining your game plan—is much smoother when you have the right tools for the job. Platforms like OTC Charts MT4 are built to give you clean historical data, letting you track your trading performance and validate every part of your strategy with real numbers. By grounding every action in data, you systematically build the quiet confidence and unshakable discipline needed for long-term success.

Frequently Asked Questions About Trading Mindset

Even after you've grasped the core ideas of trading psychology, real-world questions always pop up. I get it. So, let's tackle some of the most common things traders ask about building and keeping a sharp mindset. This is your quick-hit guide for when you need to get your head straight.

How Long Does It Take to Develop a Strong Trading Mindset?

This is a marathon, not a sprint. Think of it like getting in shape—you don't just work out for a month and then you're "fit" forever. It’s an ongoing commitment.

You can definitely see huge improvements in your discipline and emotional control within a few months of real, focused effort. But true mastery? That's a lifelong journey of learning about yourself and refining your approach. Every single day in the market throws something new at you, offering a fresh chance to grow. The goal isn't to reach some final destination; it's about constant improvement.

What Is the Most Important Habit for a Better Mindset?

If you do only one thing, do this: consistently keep a trading journal. I can't overstate how powerful this simple habit is for your psychological growth. It pulls you out of the vague, emotional fog and forces you to look at cold, hard data.

Here’s why it works so well:

- It Exposes Your Emotional Triggers: A journal makes it painfully obvious how fear, greed, or impatience are messing with your trades. You'll see your unique patterns right there on the page.

- It Keeps You Honest: It’s your accountability partner. When you write down every trade, you can’t hide from the times you broke your own rules.

- It Makes Every Trade a Learning Opportunity: Win or lose, each entry becomes a valuable piece of intel for sharpening your strategy and toughening up your mental game.

Can a Winning Strategy Fail with a Poor Mindset?

Absolutely, and it's one of the most maddening realities of trading. You could have a strategy that's a proven winner, but it's completely worthless if you don't have the discipline to actually follow it. Your mindset is the engine that runs your strategy. If that engine is sputtering, the car's not going anywhere.

A weak mindset will find a way to sabotage even a perfect system. It’s what convinces you to chase a losing trade, cut a winner short because you’re scared, or get reckless after a hot streak. It systematically destroys any edge you might have.

This is exactly why two traders can use the same system, and one makes money while the other loses their shirt. The difference isn't the strategy—it's the person executing it. To trust your system, you need to see it work. A great way to build that trust is to learn how to backtest trading strategies, grounding your confidence in historical proof, not just how you feel today.

Getting a handle on these psychological hurdles isn't optional if you want to last in this business. By facing these challenges head-on, you forge the resilient, professional trading mindset required to navigate any market condition.

Ready to pair a professional mindset with professional-grade tools? OTC Charts MT4 provides the real-time, accurate OTC data you need to execute your strategy with confidence. Stop guessing and start analyzing with charts designed for serious binary options traders. Elevate your trading with OTC Charts MT4 today.