When you're weighing options vs forex, the first thing to grasp is the fundamental difference in what you’re actually trading. With forex trading, you're in the thick of it, directly buying and selling currency pairs on a massive global stage. Think of it like swapping euros for dollars.

Options trading, on the other hand, is a different beast entirely. You're not buying the asset itself. Instead, you're buying a contract that gives you the right—but crucially, not the obligation—to buy or sell an asset at a set price before it expires. It's a game of strategy, timing, and probabilities.

Understanding the Fundamental Differences

Deciding where to put your capital—forex or options—really comes down to understanding their unique DNA. They both attract active traders, sure, but they serve very different strategies, risk tolerances, and personalities. One is about riding the powerful currents of the global economy; the other is about surgical precision and calculated risk.

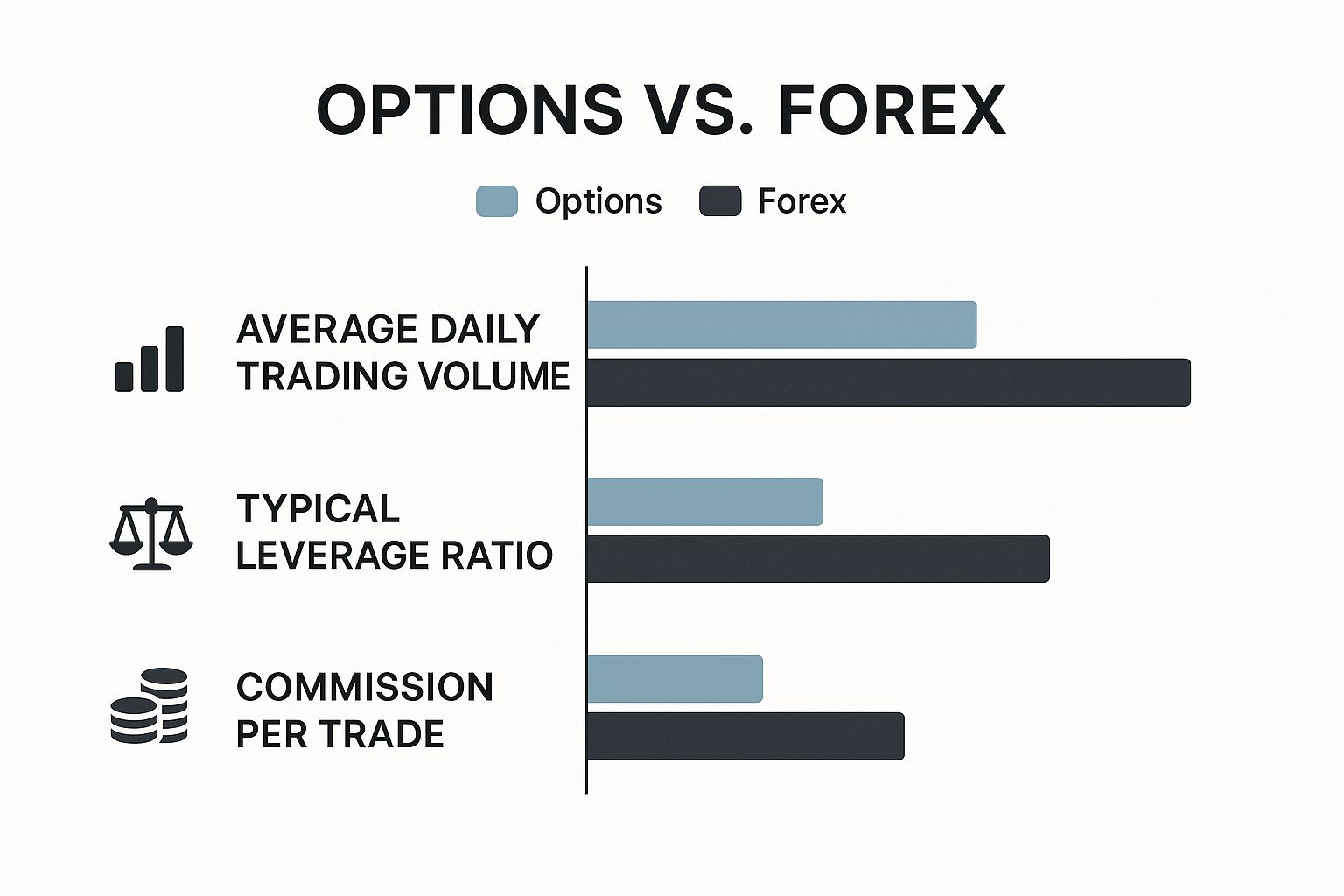

The sheer scale of the forex market is hard to overstate. It’s the largest, most liquid financial market in the world, with a staggering average daily turnover of around $6.6 trillion. To put that in perspective, the daily volume of options markets is estimated to be over $300 billion. This isn't just a numbers game; it has real-world implications.

Forex never sleeps, running 24 hours a day, five days a week, which means you can react to news from Tokyo to New York as it happens. Options are more structured, tied to the operating hours of regulated exchanges. For a deeper dive into these market dynamics, you can find a detailed forex vs options comparison to explore further.

Core Differences Between Forex and Options

To make things crystal clear, let's break down the foundational distinctions between forex and options trading at a glance.

| Feature | Forex Trading | Options Trading |

|---|---|---|

| Asset Type | Currency Pairs (e.g., EUR/USD) | Contracts on underlying assets (stocks, ETFs) |

| Market Structure | Decentralized (Over-the-Counter) | Centralized (Exchanges like CBOE) |

| Trading Hours | 24 hours, 5 days a week | Standard market exchange hours |

| Primary Goal | Profit from currency exchange rate fluctuations | Profit from price, time decay, or volatility changes |

| Risk Profile | Potentially unlimited risk/reward due to leverage | For buyers, risk is limited to the premium paid |

| Key Influences | Geopolitics, interest rates, economic data | Underlying asset price, volatility, time to expiration |

This table neatly summarizes how different these two approaches are, from the assets you trade to the very factors that move their prices.

As the infographic highlights, the forex market’s incredible liquidity and the high leverage available offer a distinct contrast to the more commission-driven, structured world of options.

Key Takeaway: Forex is a high-octane, liquidity-fueled arena perfect for traders who thrive on macroeconomic news and global trends. Options, in contrast, offer more strategic depth, letting you manage risk with surgical precision and profit from variables like volatility and time decay—not just price movement. The right choice hinges on whether you prefer the direct, high-flow participation of forex or the strategic, probability-based plays of options.

Evaluating Your Risk and Reward Potential

When it comes to binary options versus forex, the way you make—or lose—money couldn't be more different. Getting a handle on their unique risk and reward structures is non-negotiable. This isn't just theory; it's the core concept that will directly impact your trading account and shape your entire strategy.

Forex trading is well-known for offering high leverage, which is a classic double-edged sword. It lets you command a large market position with a small amount of capital, meaning tiny price swings in a currency pair can lead to massive outcomes—for better or for worse.

The Two Sides of Forex Leverage

Leverage gives you the power to enter trades far bigger than your account balance would otherwise allow. While this opens the door to significant profits from minor price changes, it also means you’re exposed to equally severe and rapid losses. A single trade moving against you can wipe out your capital in the blink of an eye.

This is where the infamous margin call enters the picture. If your losses mount to the point where your account can no longer support the leveraged position, your broker will automatically liquidate your trades to cover the debt. It's a harsh lesson many new traders learn when a bad market move erases their entire investment.

Key Differentiator: The buyer of a binary option has a defined, capped risk. The absolute most you can lose is the premium you paid to enter the trade. This built-in financial safety net is a world away from the potentially unlimited losses you can face in leveraged forex.

The Asymmetric Payout of Binary Options

Binary options work on a completely different risk-reward model, one often called asymmetric. For the buyer, the risk is fixed, but the reward is a predetermined payout. This structure is a major part of what draws people to options.

Let's say you buy a "Call" or "Up" option, betting the asset's price will be above a certain point at a specific time. You pay a premium to enter this simple yes/no proposition.

- If you're wrong: The price doesn't meet the condition. Your loss is limited to the premium you paid for the contract. That’s it. Your downside is known from the very beginning.

- If you're right: The price meets the condition. You receive a fixed, predetermined payout, which can often be a 70% to 95% return on your initial investment. The clear, fixed-payout nature creates a very straightforward risk-to-reward calculation on every single trade.

This asymmetry provides traders with a powerful, yet simple, tool. You can place targeted bets on short-term market direction with a known, limited downside. The risk dynamics between forex and binary options are starkly different and have a huge effect on how you manage your money. While forex leverage might turn a 1% market move into a 100% gain (or a total loss), a binary option offers a fixed payout if you're correct, with the loss capped at your initial stake.

No matter which market you choose, consistently evaluating your results is essential for survival. It's vital to track trading performance with care, as this is the only way to truly understand which strategies are profitable and which are just exposing you to unnecessary risk. Your choice between the linear risk of forex and the asymmetric, fixed-risk model of binary options ultimately boils down to your personal risk tolerance and trading style.

Breaking Down the Trading Mechanics

To really get to the heart of the options vs forex debate, you have to understand how a trade actually works in each world. It's not just about clicking "buy" or "sell"; the underlying mechanics are fundamentally different and demand completely separate skill sets from day one.

At its core, forex trading is built on the straightforward concept of exchanging one currency for another. Options trading, on the other hand, introduces layers of complexity that aren't immediately obvious.

In the forex market, your entire world revolves around currency pairs. Think of them as the teams competing on the field. They generally fall into three buckets:

- Majors: These are the heavy hitters like EUR/USD or GBP/USD. The US dollar is on one side of the trade, and they offer incredible liquidity with tight spreads.

- Minors (Crosses): These pairs feature major world currencies but leave the US dollar out of the equation. Think EUR/GBP or AUD/JPY.

- Exotics: Here, you're pairing a major currency with one from an emerging market, such as USD/ZAR (the US Dollar vs. the South African Rand). They're more volatile and less liquid, making them a trickier trade.

Your profit and loss are tracked in pips, which are tiny fractions of a cent representing the smallest price change. The size of your bet is determined by lots—standard, mini, or micro—which dictates how much money each pip move is worth to you.

It's a linear relationship. A ten-pip move in your favor with a standard lot equals a specific, predictable profit. Simple.

The Strategic Complexity of Options

Options trading plays a different game entirely. A forex trader is laser-focused on direction and distance. An options trader, however, is juggling a web of interconnected variables that all influence a contract's price.

The two pillars of any options contract are the strike price and the expiration date. The strike price is the price you lock in to buy (a call) or sell (a put) the asset. The expiration date is your hard deadline.

But that's just the start. The contract's actual value is constantly shifting based on a set of risk metrics known affectionately as "the Greeks." This is where it gets interesting.

Key Insight: The biggest mechanical difference, hands down, is how time impacts your trade. In forex, time is mostly a background detail unless you're holding a trade overnight and paying swap fees. In options, time is an active enemy. It’s an asset called Theta that is constantly decaying, eating away at your contract's value and forcing you to be right about timing, not just direction.

Getting a handle on the Greeks is non-negotiable for any serious options trader:

- Delta: This tells you how much your option's price should move for every $1 change in the underlying stock or asset.

- Theta (Time Decay): This is the silent killer. It represents how much value your option loses each day as it gets closer to expiration.

- Vega: This measures an option's sensitivity to volatility. It tells you how the price changes for every 1% shift in the asset's implied volatility.

This multi-layered reality means two traders could be bullish on the same stock but execute wildly different strategies based on how they view time decay and future volatility. For anyone new to trading, this requires a much deeper dive than learning forex basics. Building a solid foundation in market analysis is crucial, and our guide on technical analysis for beginners is a great starting point for the charting skills you'll need in either market.

Essential Trading Terminology Compared

The learning curve in the options vs forex discussion really comes into focus when you lay their core concepts side-by-side. The table below breaks down these fundamental differences, clarifying why one is a direct bet on price while the other is a strategic game of probabilities.

| Concept | Relevance in Forex | Relevance in Options |

|---|---|---|

| Price Movement | The primary driver of profit and loss. Success hinges on correctly predicting the direction and magnitude of a price change. | A major factor, but profit is also shaped by volatility (Vega) and the relentless passage of time (Theta). |

| Time Factor | Mainly relevant for overnight swap/rollover fees on open positions. It's not a constant pressure during the trading day. | A critical, ever-present force. Options are "wasting assets" that lose value every single day due to time decay. |

| Volatility | A market condition that increases risk and reward by creating larger price swings. You react to it. | A tradable metric in itself. Traders can profit from changes in implied volatility, even if the price goes nowhere. |

| Position Sizing | Managed through lot sizes (standard, mini, micro) to control your exposure and the value of each pip. | Managed by the number of contracts and the specific strike price you choose, affecting both cost and leverage. |

Ultimately, a forex trader is constantly asking, "Where is the price going?" An options trader has to ask a much more complex question: "Where is the price going, by when, and how wild will the ride be?" This single difference defines the entire mechanical approach you'll take.

Of course. Here is the rewritten section, designed to sound natural, human-written, and expert-led.

Putting It All Together: A Real-World Market Scenario

Theory is great, but the real test is seeing how these two markets behave in the wild. This is where the core differences between forex and options truly come to life. Let's ditch the abstract concepts and walk through a classic, high-stakes event: a central bank dropping an unexpected interest rate hike.

This is the kind of news that sends shockwaves through the market. It creates a massive jolt of volatility and a strong, almost undeniable, directional push. But a forex trader and an options trader will look at this exact same event and see two completely different opportunities, leading them down wildly different strategic paths.

How a Forex Trader Plays the News

For a pure forex trader, a surprise rate hike is about as straightforward as signals get. When a country's interest rates go up, it tends to attract foreign capital, which in turn strengthens its currency. The goal here is simple: get in on that move, fast.

Imagine the European Central Bank (ECB) suddenly announces a rate increase. The forex trader's playbook is almost instinctual:

- Pick the Vehicle: The most obvious choice is the EUR/USD pair. It’s the most traded pair for the euro, meaning there's massive liquidity to get in and out smoothly.

- Pull the Trigger: They'll immediately go long (buy) on EUR/USD, betting that the euro will climb against the US dollar.

- Manage the Trade: A stop-loss is placed just below a recent support level to cap potential losses, and a take-profit is set at a logical resistance point or to lock in a solid risk-to-reward ratio.

This entire trade is a direct bet on direction. The profit potential is linear—the more pips the EUR/USD climbs, the more money they make. The focus is entirely on capturing that raw price movement. It's a game of speed, liquidity, and being right about where the price is headed.

The Bottom Line: The forex trader uses big news for a direct, directional play. Their strategy is built on speed and profiting from the currency's straightforward move. It's all about correctly predicting where the price will go.

The Options Trader's Volatility Play

An options trader sees the same ECB announcement and thinks differently. Yes, there's a directional clue, but the one thing they know for sure is that the market is about to get chaotic. They see guaranteed volatility. They might not be 100% certain of the immediate direction, or they might simply want to profit from the explosive move itself, regardless of where it goes.

Instead of just buying the asset, they might execute a straddle. This involves buying both a call option and a put option on a euro-tracking asset (like an ETF), both with the same strike price and expiration date.

- The Call Option: Profits if the price shoots up.

- The Put Option: Profits if the price tanks.

With this setup, the trader makes money as long as the price moves dramatically in either direction—enough to cover the premium they paid for both options. They don't have to guess the outcome of the ECB's decision perfectly; they just need to be right that there will be a massive reaction. This is a pure bet on volatility, not direction.

Unique Strategies: Where One Market Shines and the Other Can't Compete

Looking beyond single news events, you start to see how each market is tailored for specific, powerful strategies that simply don't translate to the other.

Hedging a Portfolio with Options

Let's say you have a large portfolio of US tech stocks and you're getting nervous about a potential market correction. Forex trading offers no direct way to shield this specific group of assets.

With options, however, you can buy put options on the QQQ ETF, which tracks the Nasdaq 100. If the tech sector takes a nosedive, the profits from your put options can help cushion or even cancel out the losses in your stock portfolio. It's a precise and powerful risk management tool that is fundamentally unique to options.

Playing Long-Term Trends with Forex

On the flip side, imagine a macro investor who believes the Japanese economy is set for long-term decline while the US economy will continue to strengthen. Forex is the perfect instrument for this kind of broad, multi-year thesis.

They could open a short position on the JPY/USD pair and hold it for months, or even years. Not only would they profit from the long-term trend, but they could also collect positive swap fees along the way (a "carry trade"). This kind of sweeping, macroeconomic trend-following is what the forex market was built for.

Ultimately, deciding between options vs forex comes down to what you're trying to accomplish. Are you making a direct bet on price? Profiting from a volatility spike? Protecting a specific portfolio? Or riding a multi-year economic trend? Your strategic goal will always point you to the right tool for the job.

Choosing Your Essential Trading Tools and Platforms

Your success as a trader, whether in options or forex, hinges on the quality of your toolkit. A great platform isn't just a button to click for placing trades; it’s your command center for deep analysis, strategic planning, and managing risk. The technology for forex and options has really evolved on separate tracks, each one fine-tuned for the unique demands of its traders.

When you step into the forex world, one name stands above all others: MetaTrader. Whether you’re using the classic MT4 or its successor, MT5, it's the industry benchmark for good reason. It’s packed with robust charting tools, a massive library of technical indicators, and, crucially, the ability to automate your trading with Expert Advisors (EAs).

This built-in support for trading robots and custom-built indicators gives forex traders a ton of flexibility. Because it's so widely used, there's also a huge community out there offering support, custom tools, and shared knowledge.

The Specialized World of Options Platforms

Options trading is a different beast entirely, and it demands a much more specialized set of tools. Your standard charting package just won't cut it. This is where platforms from dedicated options brokers like Tastytrade or Interactive Brokers truly shine, as they're built from the ground up for the complexities of options.

Their entire interface is often built around the interactive options chain—the absolute heart of an options trader's workflow. This grid lays out all available puts and calls for an asset, neatly organized by strike price and expiration date, letting you analyze and execute trades in a flash.

Key Takeaway: Think of it this way: a forex platform is engineered for speed and the direct analysis of price movement. An options platform is more like a strategic dashboard, designed to help you manage multiple variables like price, time, and volatility all at once. The market you choose will absolutely dictate the technology you'll need to master.

These specialized platforms go far beyond basic charts, offering features that are non-negotiable for anyone serious about trading options.

- Profit/Loss Calculators: Before you even risk a penny, these tools let you model the potential outcomes of your trade. You can see exactly how a change in the underlying stock's price will impact your profit and loss.

- Risk Graph Visualizers: This is arguably the most powerful tool in the box. It gives you a clear visual of your trade's profit potential, its breakeven points, and your maximum risk across a whole range of prices. It’s an instant snapshot of your position's dynamics.

- Implied Volatility (IV) Analysis: Options platforms give you the tools to track and analyze metrics like IV Rank, which tells you if the current implied volatility is high or low compared to its past behavior. This is essential for strategies that aim to profit from changes in volatility itself.

Comparing Analytical Tools Side-by-Side

While both forex and options traders rely on standard technical indicators like the RSI or MACD to get a feel for momentum and trends, that's where the similarities in their toolkits end.

| Analytical Tool | Primary Use in Forex | Primary Use in Options |

|---|---|---|

| MACD / RSI | Pinpointing overbought/oversold levels and trend strength in a currency pair. | Informing your directional guess on the underlying stock before you pick a strategy. |

| Fibonacci Retracement | Finding potential support and resistance zones to plan your entry and exit points. | Identifying potential strike prices for your calls or puts based on where you expect the price to pull back. |

| Implied Volatility (IV) | Not a primary tool. Forex traders react to volatility; they don't typically analyze it as a tradable metric. | A core concept. It's used to find "cheap" or "expensive" options and to build volatility-based trades like straddles. |

| The "Greeks" | Does not apply. Forex risk is linear—based purely on your position size and how far the price moves. | Essential for risk management. Delta, Gamma, Theta, and Vega are used to measure risk from every angle—price, time decay, and volatility shifts. |

This clear divide in tooling gets right to the heart of the options vs forex debate. A forex trader needs a powerful charting engine and lightning-fast, reliable execution. An options trader, on the other hand, needs a much more analytical platform, one that can model complex scenarios with multiple moving parts. Your choice ultimately comes down to whether you prefer the direct price-action analysis of forex or the strategic, probability-driven world of options.

Which Market Best Fits Your Trading Personality

Ultimately, the options vs forex debate isn't about which one is "better" in some objective sense. The real question is, which market is the right fit for you? Your personality, how you handle risk, and what you want to achieve are the most important pieces of the puzzle. Are you built for the fast, liquid world of currency trading, or does the strategic, multi-layered nature of options better suit your analytical mind?

This is more than just a simple preference. It's about placing yourself in an environment where your natural tendencies become advantages. Getting this right can be the difference between building a sustainable trading career and burning out quickly.

The High-Frequency Scalper Profile

Do you thrive on action? Do you prefer making quick decisions and seeing results almost instantly? If so, you might be a high-frequency scalper. This type of trader aims to grab small, consistent profits from dozens—sometimes hundreds—of trades in a single day. For this personality, the forex market is almost always the better arena.

The forex market runs 24/5 and offers incredible liquidity, especially in major pairs like EUR/USD. This means there's almost always a chance to jump in and out of a position with minimal delay or cost. A scalper’s game is won with tight spreads and lightning-fast execution, two things the forex market excels at. Because forex profits are linear (a pip's value is straightforward), you can focus entirely on price action and speed without extra layers of complexity.

The Strategic Analyst Profile

On the other hand, some traders are more like chess players. They enjoy digging into multiple variables, planning their moves carefully, and building trades where the risk and reward are meticulously defined. This is the strategic analyst, and they often feel right at home trading options.

This trader isn't sweating the tiny, minute-to-minute price wiggles. They're focused on the bigger picture.

- Volatility as an Asset: They might look at an option's implied volatility to determine if it's "cheap" or "expensive," a completely different analysis from just predicting the underlying asset's direction.

- Time as a Factor: They can use time decay (Theta) as a tool, selling options to generate income as each day passes.

- Complex Strategies: They can construct trades like spreads, iron condors, or straddles to profit from very specific scenarios, like a market going nowhere or a sudden explosion in volatility.

This style is all about precision and probability, not speed. It demands a patient and analytical mind that can comfortably juggle several moving parts at once.

Key Insight: Your psychological makeup is a huge part of the equation. A trader who craves constant action will likely get bored and impatient waiting for an options play to develop. A deep strategic thinker might feel chaotic and reckless in the rapid-fire world of forex scalping.

The Portfolio Manager and Hedger Profile

Finally, let's look at the trader who isn't just speculating but is also trying to protect their existing investments. For portfolio managers or long-term investors, options provide a powerful tool that forex simply can't match: hedging.

Imagine you have a large portfolio of tech stocks and are worried about a potential market downturn. Trading forex won't offer any direct protection for those specific stocks. With options, however, you could buy put options on a tech-heavy ETF (like the QQQ). If the tech sector does fall, the profits from your put options can help cushion the losses in your stock portfolio, acting like an insurance policy. This defensive power is a fundamental strength of options.

Your choice really comes down to an honest look at your capital, the time you can commit, and your own psychological grit. Understanding the mental game is every bit as crucial as your technical charting skills. To get a head start, exploring expert advice on building the right mindset can give you a serious edge. You can learn more by checking out our guide on trading psychology tips and seeing how to apply them on your own journey. When you match your personality to the right market, you give yourself the best possible shot at success.

Common Questions: Options vs. Forex Trading

When you're starting out, figuring out where to put your time and money can feel overwhelming. Let's break down some of the most common questions traders have when weighing options against forex. This should give you a clearer picture of which market might be a better fit for you right now.

Is Forex or Options Better for a Beginner?

For someone brand new to trading, forex is almost always the more straightforward starting point. At its heart, you're just trading one currency for another. The core task is predicting whether a currency pair will go up or down, which makes the learning curve much less steep.

Options, on the other hand, throw a lot more at you from the get-go. You have to immediately get comfortable with concepts like strike prices, expiration dates, and the infamous "Greeks" (like Delta and Theta). This can be a lot to juggle when you're still trying to learn the basics of reading a chart. Forex lets you build a solid foundation in market analysis and risk management without that extra layer of complexity.

What Is the Minimum Capital to Start?

This is where forex really stands out. Its low barrier to entry is a huge plus for new traders. Thanks to micro and mini lots, many brokers will let you open an account and start trading with as little as $100. This allows you to get your feet wet with real money without taking a massive financial risk.

Options trading usually asks for a bit more upfront. While the premium to buy a single option contract can be low, most brokers have higher minimum deposit requirements. You'll typically need somewhere in the range of $500 to $2,000 to get started, especially if you plan on using more advanced strategies that require margin.

Key Takeaway: It really comes down to your personality and how you prefer to learn. Forex is simpler to grasp initially, as it's all about price direction. Options offer clearly defined risk for buyers, but you must master tricky variables like time decay and volatility from day one.

Can You Realistically Make a Living from Trading?

Yes, people do make a living from both options and forex, but let's be crystal clear: it's incredibly challenging and not a realistic expectation for someone just starting. The pros who succeed have usually spent years honing their strategies, mastering risk management, and developing unshakable discipline.

This isn't a get-rich-quick scheme. Success is built on consistency, constant learning, and treating your trading as a serious business. The hard truth is that the vast majority of retail traders lose money. Walking into either market expecting to quit your day job in a month is a recipe for disaster.

Can I Trade Both Options and Forex?

Absolutely. In fact, many seasoned traders are active in both markets because they use them for different things. For example, a trader might day trade forex pairs based on breaking economic news but use options for longer-term strategies, like hedging their stock portfolio or making a bet on future market volatility.

The key is knowing what you're doing. To trade both successfully, you need a deep understanding of how each market works and keep your strategies for each one separate. If you're a beginner, your best bet is to pick one market, truly master it, and only then consider adding the other to your skillset.

For traders who specialize in the unique world of binary options, the right charting tool is non-negotiable. OTC Charts MT4 delivers the professional-grade, real-time OTC quotes you need, plugged directly into the MetaTrader 4 platform you already know. It gives you the analytical edge required for precision, especially when trading on weekends or after the main markets have closed. Take your strategy to the next level by visiting OTC Charts MT4.