Think of a trading plan template as your personal business plan for navigating the markets. It’s more than just a document; it’s a concrete roadmap that lays out your goals, defines your tolerance for risk, and specifies the exact rules you’ll follow for every single trade—from entry to exit. This is what truly separates disciplined, professional trading from a costly gambling habit.

Why Trading Without a Plan Is a Losing Game

Let's cut right to the chase: trading without a plan is a recipe for disaster. I've seen it countless times—traders dive into the markets, fired up by a hot tip from social media or a gut feeling, and then get completely wiped out. Why? Because they make emotional decisions in a chaotic environment that preys on impulse.

A well-defined strategy is your anchor in the storm. It keeps you grounded and prevents you from making the same psychological mistakes that take out the majority of market participants.

Sidestepping Emotional Trading Traps

A written plan is your strongest shield against your own worst instincts. It helps you systematically avoid the destructive habits that can plague even seasoned traders if they let their guard down:

- Fear of Missing Out (FOMO): We’ve all been there. A currency pair explodes higher, and every fiber of your being screams "get in now!" A solid plan, with its strict entry criteria, stops you from chasing these high-risk, low-probability setups.

- Revenge Trading: After a tough loss, the urge to jump right back in and "make it back" is powerful. Your plan acts as a circuit breaker, enforcing a cooling-off period or a hard maximum daily loss limit that forces you to protect your capital and your sanity.

A trading plan forces you to trade your strategy, not your emotions. It’s the single most effective tool for building the discipline required for long-term consistency in the financial markets.

The Data Proves It

The stark contrast between traders with a plan and those without isn't just a collection of stories—it's backed by some compelling numbers.

Brokerage performance reviews repeatedly find that traders who stick to a structured plan can improve their consistency rates by a staggering 30% to 50%. Think about what that kind of improvement could do for your bottom line.

Here’s a quick breakdown of how planned trading stacks up against its chaotic counterpart:

| Metric | Trader with a Plan | Trader without a Plan |

|---|---|---|

| Decision Making | Objective & Rule-Based | Emotional & Impulsive |

| Consistency Rate | Up to 50% Higher | Inconsistent, often negative |

| Risk Management | Pre-defined & Controlled | Reactive & often ignored |

| Long-Term Survival | Significantly Higher | Very Low |

The data paints a clear picture: structure and discipline are not optional for success.

A 2022 survey from a major trading platform drove this point home. It revealed that traders who simply documented their setups and reviewed their outcomes saw their risk-adjusted returns improve by a median of 17% in just six months. This really underscores how using a trading plan template can bring much-needed clarity and discipline to your process. If you're interested in the specifics, you can explore the details on these trading plan findings and their impact on profitability.

Building Your Personal Trading Blueprint

Starting with a generic trading plan template is fine—it gives you a skeleton to work with. But the real money, the consistency we're all chasing, comes from making that plan your own. Think of it like a bespoke suit. The off-the-rack version might fit okay, but the one tailored to your exact measurements moves with you and just feels right. Your plan needs to do the same, fitting your personality, risk appetite, and the reality of your daily life.

This all starts by getting specific. "I want to make more money" is a wish, not an objective. You have to define what success actually looks like in your world. Are you trying to generate enough cash to cover the monthly car payment? Or are you aiming for serious long-term capital growth for retirement? These are two very different roads, and they demand completely different strategies and approaches to risk.

Defining Your Trading Identity

Before you even glance at an entry signal, you need to have a frank conversation with yourself about who you are as a trader. Your plan has to work with your lifestyle, not fight against it. A strategy that demands you stare at the charts for six hours straight is completely worthless if you have a 9-to-5 job and a family.

So, let's get honest. Ask yourself:

- What's my real risk tolerance? Can you watch your account draw down 5% and stick to the plan without breaking a sweat? Or does a tiny 1% loss have you panicking and second-guessing everything?

- What markets actually fascinate me? You’ll put in better work and trade with more confidence if you're genuinely interested in what you're trading, whether that's major forex pairs, commodities like gold, or specific OTC assets.

- How often do I realistically want to trade? Do you see yourself as a scalper, in and out of dozens of trades a day? Or are you more of a swing trader, holding positions for a few days? Maybe you're a position trader who only checks in on weekly charts.

Your answers here will point you toward a style that feels natural. That's the secret to sticking with it. A patient, analytical person will likely burn out scalping but might find a perfect rhythm with swing trading. It has to feel right for you.

Building Your Daily Trading Routine

A solid, repeatable routine is the engine that drives your trading plan. It brings much-needed structure and automates many of the small decisions, which saves your precious mental energy for analyzing the market itself. This isn't just about picking a time to trade; it’s about how you prepare, execute, and review.

I find it helpful to break the routine into three clear phases:

- Pre-Market Analysis: This is your homework. It’s a non-negotiable checklist you run through before your session. For me, that means checking the economic calendar for any big announcements, plotting out the key support and resistance levels for the day, and flagging any potential setups that already fit my strict criteria.

- The Trading Session: This is game time. Your plan is your playbook. You are not a maverick; you are an operator. You only take the trades that your rules explicitly allow. No exceptions.

- End-of-Day Review: This is where the real growth happens. You log every trade, making notes on your emotional state and analyzing what went right and what went wrong. Did you follow your plan to the letter? If not, why?

A great trading plan isn't a rigid script you throw out after a losing streak. It’s a living document that guides your actions, builds discipline, and evolves with your experience in the markets.

By crafting a routine that fits your schedule, you stop treating trading like a chaotic gamble and start running it like a disciplined business. This blueprint becomes your North Star, helping you navigate the markets with confidence, no matter what they throw your way.

Defining Your Precise Entry and Exit Rules

This is where the rubber meets the road in your trading plan template. It's the point where theory becomes execution. Ambiguous rules are a trader's worst enemy—they lead to hesitation, second-guessing, and expensive mistakes made in the heat of the moment. We need to get away from flimsy ideas like "buy the dip" and nail down crystal-clear, non-negotiable criteria.

Think of these rules as a pilot's pre-flight checklist. There's simply no room for interpretation when the outcome is on your shoulders. Your entry and exit rules need that same level of precision, leaving zero space for emotions to creep in and wreck your plan.

From Vague Concepts to Concrete Triggers

The real work here is translating your general market analysis into specific, actionable signals. It doesn't matter if you’re a pure technical trader, a fundamental analyst, or some combination of the two; your rules have to be so specific that another trader could look at your chart and know instantly whether a valid setup is present.

Let's look at how to transform a vague idea into a real, testable rule:

-

Vague Idea: "I'll buy when the market looks bullish."

-

Specific Rule: "I will enter a long position ONLY IF the 50 EMA crosses above the 200 EMA on the 1-hour chart, and the RSI is below 70 to ensure it's not overbought."

-

Vague Idea: "I'll go short if price seems weak at resistance."

-

Specific Rule: "I will enter a short position ONLY IF the price tests the established daily resistance level, prints a bearish engulfing candle on the 4-hour chart, and the MACD histogram confirms declining momentum."

See the difference? The specific rules are binary. The conditions are either met, or they're not. This simple shift removes the immense pressure of making a subjective decision when money is on the line.

Setting Logical Profit Targets and Stop-Losses

Finding an entry is only one piece of the puzzle. Every single trade you take needs a predetermined exit plan—one for taking profits and one for cutting losses. If you don't have these, you're not trading; you're just gambling.

Your stop-loss is your risk management in action. Your profit target is what makes the risk worthwhile. Never enter a trade without knowing exactly where you'll exit for both a win and a loss.

A logical stop-loss isn't just a random price. It's usually placed based on market structure. For example, a common spot is just below a recent swing low for a long trade or just above a swing high for a short. If the price hits that level, your trade idea is officially invalidated, and it's time to get out.

Profit targets, on the other hand, should always provide a favorable risk-to-reward ratio. If you're risking 50 pips on a trade, setting a target 100 pips away gives you a solid 1:2 risk-to-reward ratio. This fundamental principle is what allows traders to be consistently profitable even if they only win 50% of their trades.

Time and time again, data shows that this structured approach works. Studies have found that traders who stick rigidly to predefined rules significantly outperform those who trade on gut feelings. For instance, one analysis of day traders revealed that those with rule-based strategies had noticeably higher win rates (55-60% versus 40-45%) and superior average risk-reward ratios. You can read the research on how planned strategies impact profitability for yourself.

Nailing down these rules is a vital step. For traders using platforms like Pocket Option, having the right system is everything. To learn more about building out your full methodology, take a look at our guide on creating an effective Pocket Option strategy, which builds on these core principles.

Mastering Your Risk and Money Management

Let's get one thing straight: even the most perfect entry signal is useless without a rock-solid defense.Let's get one thing straight: even the most perfect entry signal is useless without a rock-solid defense. I’ve seen it time and again—the best traders in the world are, first and foremost, elite risk managers. Without it, you can wipe out an account faster than you can say "margin call."

This part of your trading plan template is arguably the most critical for your survival. It's all about protecting your capital so you have the chips to stay in the game long enough for your edge to play out. Your defense is built on two core pillars: how you size your positions and the overall risk limits you set for your entire portfolio.

Think of these not as suggestions, but as the non-negotiable laws that govern your trading business.

Calculating Your Position Size

The single biggest mistake I see new traders make is winging it, risking a random amount on each trade. A professional trading plan template takes all the guesswork out of the equation. It uses a simple formula to ensure you never risk more than a small, predefined percentage of your account on any one idea.

A sustainable and widely accepted rule of thumb is to risk no more than 1% to 2% of your capital on a single trade. That's it. This keeps you safe from the one catastrophic loss that can end a career before it starts.

The formula is straightforward:

Position Size = (Total Account Capital x Risk Percentage) / Stop-Loss Distance

Let's walk through a real-world example. Imagine you have a $10,000 account and you've committed to a maximum risk of 1% per trade. You spot a setup, and your analysis tells you the stop-loss needs to be 50 pips away.

- First, calculate your max dollar risk: $10,000 x 0.01 = $100.

- Next, determine the value of your stop-loss: 50 pips.

- Now, you can calculate the correct position size. Assuming a value of $10 per pip for a standard lot, the math is: $100 / (50 pips * $10/pip) = 0.2 standard lots.

By running this calculation for every single trade, you standardize your risk. A winner provides a meaningful gain, while a loser is just a small, manageable, and pre-calculated business expense.

To illustrate how this works in practice, here are a few more examples.

Position Sizing Calculation Examples

| Account Balance | Risk Per Trade (%) | Stop-Loss (Pips/Points) | Calculated Position Size |

|---|---|---|---|

| $5,000 | 2% | 40 | 0.25 standard lots |

| $10,000 | 1% | 50 | 0.20 standard lots |

| $25,000 | 1.5% | 75 | 0.50 standard lots |

| $50,000 | 0.5% | 100 | 0.25 standard lots |

As you can see, the position size adapts based on your rules and the specific trade's parameters, but your percentage risk always stays consistent.

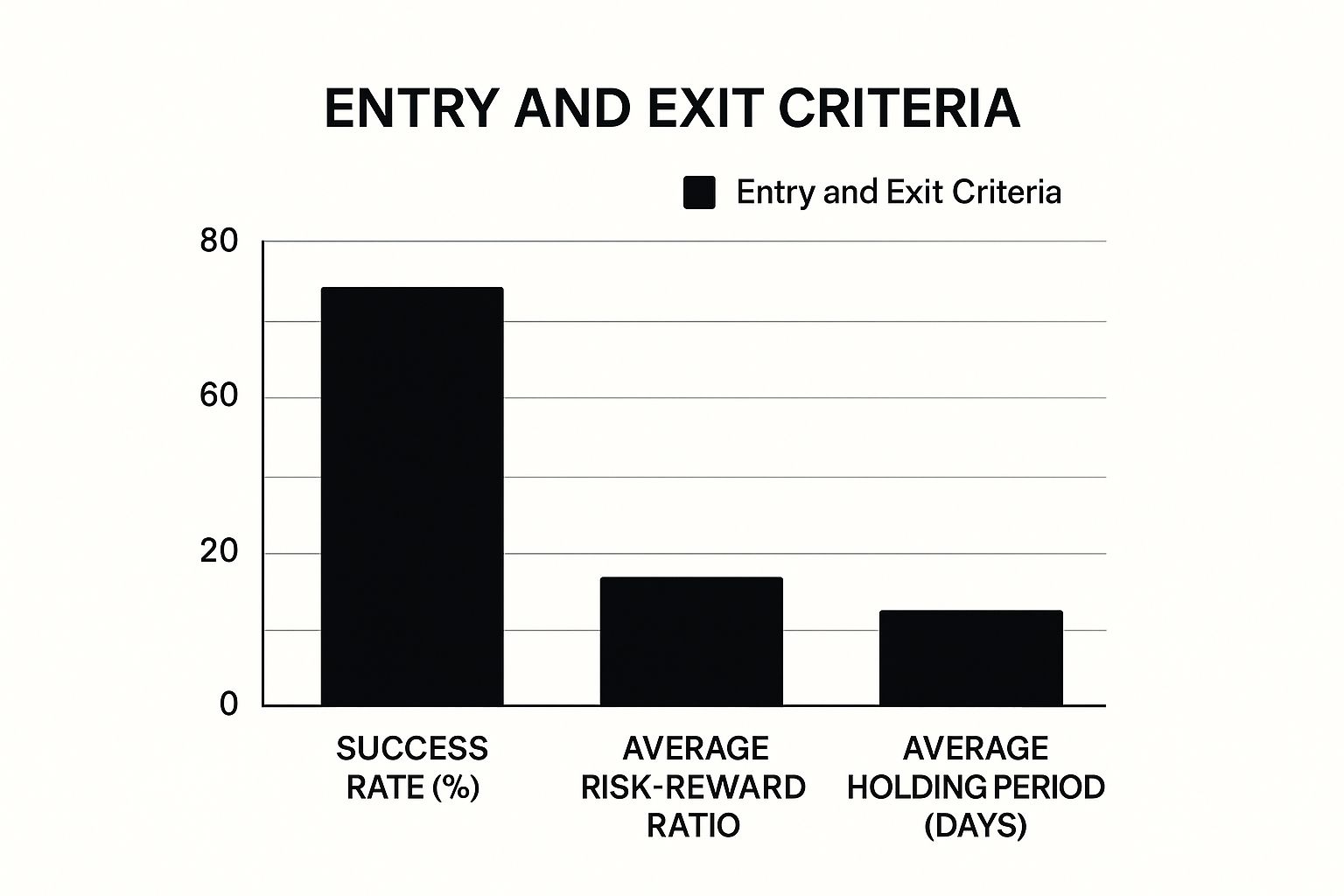

The chart below shows some of the key metrics that a disciplined plan, underpinned by strict risk management, helps you control and optimize over the long haul.

This visual reinforces how a structured approach directly impacts your success rates, risk-reward ratios, and holding periods—all of which are stabilized by consistent risk controls.

Setting Your Portfolio Risk Limits

Managing risk on a per-trade basis is crucial, but it's only half the battle. You also need to manage your total portfolio exposure. This means setting hard limits that act like circuit breakers, forcing you to step away and prevent emotional "revenge trading" during a losing streak.

Your primary job as a trader is not to make money, but to protect the capital you already have. Profit is the byproduct of excellent risk management.

Here are two essential portfolio rules to build into your plan:

- Maximum Daily Loss: This is a hard stop for your trading day. You might decide, for example, that if your account balance drops by 3% in a single session, you are done. You close all positions, turn off the screens, and walk away. This rule prevents one bad day from spiraling into a disaster.

- Maximum Drawdown: This is the largest peak-to-trough decline your account can handle before you take a mandatory break. A common limit is 10%. If your account hits a new equity high and then drops by 10%, you stop trading for a week to review your journal, analyze what went wrong, and wait for better market conditions.

These rules are your ultimate safety net. They guarantee that no matter what the market throws at you, you will live to trade another day.

For traders focusing on less common asset classes, it's worth noting that risk parameters can vary. You can learn more about these nuances when trading OTC markets in our detailed guide. Ultimately, mastering these risk principles is what truly separates the professionals from the gamblers.

Reviewing and Refining Your Trading Plan

One of the biggest mistakes I see traders make is treating their trading plan template as if it's carved in stone. They write it, they read it, and then they file it away. But here’s the thing: a plan that doesn't evolve is a plan that’s destined to fail.

The markets are always in motion, your own skills are (hopefully) improving, and your strategy has to adapt right along with them. A disciplined review process is what turns your trading journal from a simple logbook of wins and losses into an engine for genuine growth.

This isn’t about frantically changing your strategy after a single bad trade. It's about building a structured, data-driven feedback loop. This is how you shift from being a reactive trader, swayed by emotion, to a proactive analyst of your own performance. You start systematically rooting out costly mistakes and reinforcing the habits that actually make you money.

Running Effective Performance Reviews

Consistency is everything here. You absolutely must schedule regular, non-negotiable appointments with yourself to review your performance. A rhythm I’ve found incredibly effective is a quick weekly check-in combined with a more thorough monthly deep dive.

- Weekly Review: Think of this as your tactical huddle. Did I stick to my rules on every single trade? Did emotion creep in anywhere? Make a note of any deviations and tally up your core metrics for the week.

- Monthly Review: This is your strategic sit-down. You're zooming out to see the bigger picture. Are there any nagging, recurring patterns showing up in my wins or losses? Is one particular setup carrying the team while another is dragging me down?

This structured approach prevents you from making knee-jerk decisions based on the emotional rollercoaster of a single trading day. Instead, you're making adjustments based on a solid sample size of trades.

Your trading journal's true power isn't in just tracking P&L. It's in uncovering the why behind your results. That data is the raw material for objective, meaningful improvement.

Key Metrics to Track

To get real, actionable insights, you have to look past the number in your account balance. Digging into specific performance metrics is what tells the true story of what's working and what isn't.

Make sure your trade journal is tracking these, at a minimum:

- Win Rate: Simple enough—the percentage of your trades that close in profit.

- Average Risk-to-Reward Ratio: This is crucial. You need to compare the size of your average winner to your average loser. A 70% win rate means nothing if the 30% of losers are so big they wipe out all your hard-earned gains.

- Performance by Setup: This is a game-changer. Tag every trade with the specific setup that triggered it. You might discover your "breakout" strategy is a consistent winner, but your "mean reversion" trades are a slow bleed on your account.

When you analyze this data, you'll start spotting powerful patterns. Maybe you realize your win rate skyrockets during the London session, or that your biggest, most impulsive losses almost always happen on a Friday afternoon. This is the kind of specific insight that lets you refine your trading plan with surgical precision. You can double down on what works and cut out what doesn’t.

For more in-depth strategies and professional insights, I highly recommend exploring the articles on the OTC Charts MT4 blog.

Still Have Questions About Your Trading Plan? Let's Clear Them Up

Even with a perfectly crafted trading plan template, it's natural to have questions. In fact, questioning your plan is healthy—it means you're thinking critically. Having real clarity and conviction in your rules is what will keep you from throwing them out the window when the market gets volatile.

So, let's dive into some of the most common questions I hear from traders, both new and seasoned.

A big one is: "How often should I change my plan?" Your trading plan isn't meant to be set in stone, but you can't be changing it every other day either. Think of it as a living document that evolves with your experience. A good rhythm is to review its performance weekly and then consider making thoughtful, strategic adjustments on a monthly basis.

Don't even think about overhauling your core rules until you have a solid chunk of data to back up your decision. I'm talking about a minimum of 50 to 100 trades. The absolute worst time to change a rule is during the trading day, or even worse, while you're in an open trade. That's just emotion talking, not strategy.

What's the Single Most Important Part of a Trading Plan?

If you forced me to pick just one, it would be risk and money management, without a doubt. This section is the bedrock of your entire trading career.

Defining your maximum risk per trade (a standard is 1% of your capital), your position sizing model, and your "kill switch" for the day (a max daily loss) is what guarantees your survival. I've seen traders with a so-so entry strategy make money because their risk management was impeccable. I've never seen the reverse hold true. Superior risk management protects your capital, and your capital is the lifeblood of your trading business.

Another common question is whether it’s okay to have more than one trading plan.

Yes, absolutely! It's actually a sign of an advanced trader. You might have:

- A plan for trending markets designed to catch and ride big moves.

- A plan for range-bound markets focused on buying support and selling resistance.

- Strategy-specific plans, like one for news-based breakouts and another for fading overextended moves.

The trick is to be crystal clear about which plan you’re using and why based on what the market is telling you right now. This keeps you organized and ensures you’re not trying to fit a square peg in a round hole.

If you're constantly breaking your own rules, that's a massive red flag. It points to one of two things: a serious psychological block or a plan that's fundamentally broken.

First, be brutally honest with yourself. Is your plan too aggressive or just not a good fit for your personality? If the plan itself is solid, then the issue is discipline. A great way to fix this is to slash your position size way down—make it so small that the money doesn't matter. This allows you to focus purely on execution until following your plan becomes second nature.

Ready to execute your plan with precision? OTC Charts MT4 delivers the professional-grade, real-time data you need right inside your MetaTrader 4 platform. Stop guessing and start seeing the OTC markets with clarity. Get the ultimate charting solution today.